990 Ez Printable Form

990 Ez Printable Form - Some months may have more than one entry due to the size of the download. Address change name change initial return Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Enter amount of tax on line 40c reimbursed by. The download files are organized by month. This form is for income earned in tax year 2022, with tax returns due in april 2023. On this page you may download the 990 series filings on record for 2021. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

Address change name change initial return The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: On this page you may download the 990 series filings on record for 2021. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. The download files are organized by month. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. This form is for income earned in tax year 2022, with tax returns due in april 2023. Some months may have more than one entry due to the size of the download.

Some months may have more than one entry due to the size of the download. The download files are organized by month. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: This form is for income earned in tax year 2022, with tax returns due in april 2023. On this page you may download the 990 series filings on record for 2021. Enter amount of tax on line 40c reimbursed by. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Address change name change initial return

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and.

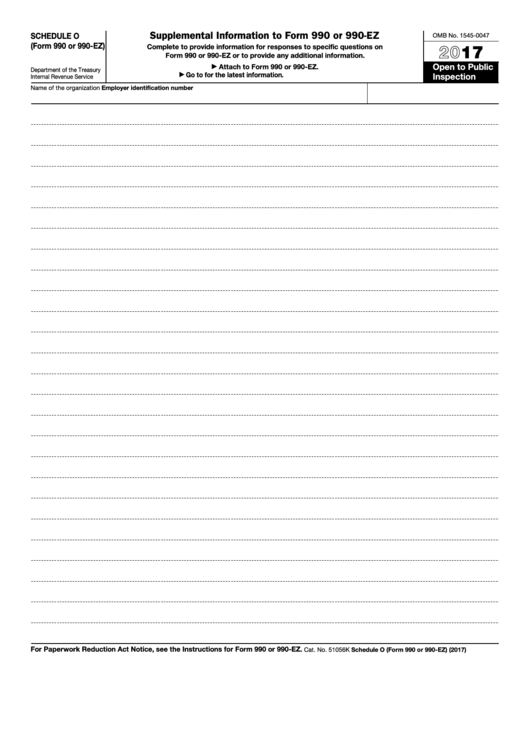

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The download files are organized by month. Some months may have more than one entry due to the size of the download. The information provided will enable you to file a more complete return and.

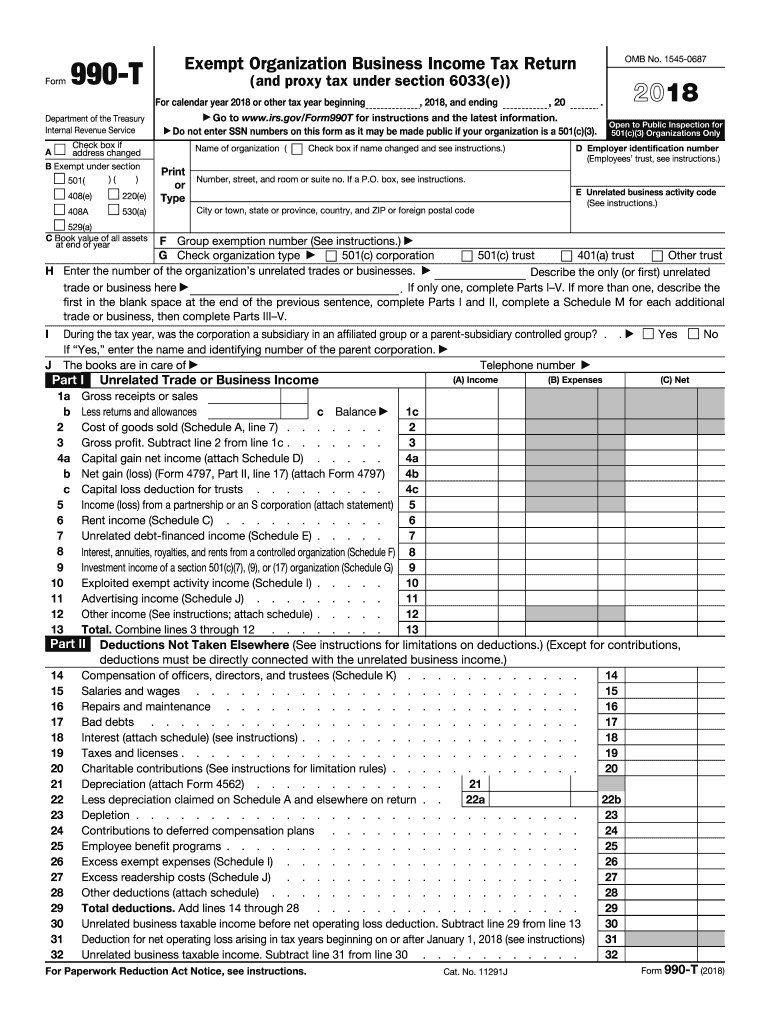

990 t Fill Out and Sign Printable PDF Template signNow

The download files are organized by month. Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Web enter amount of.

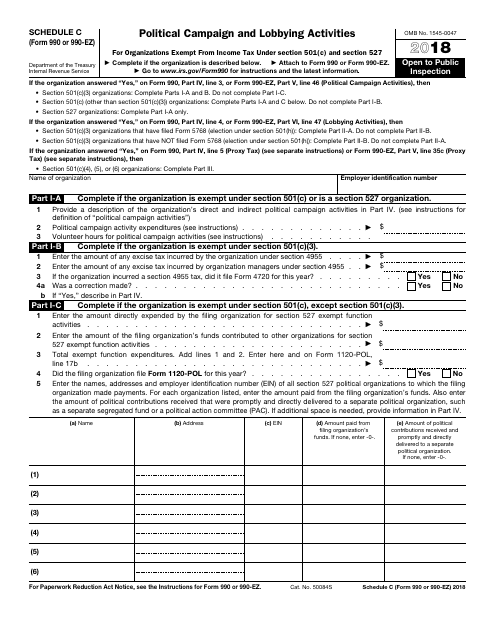

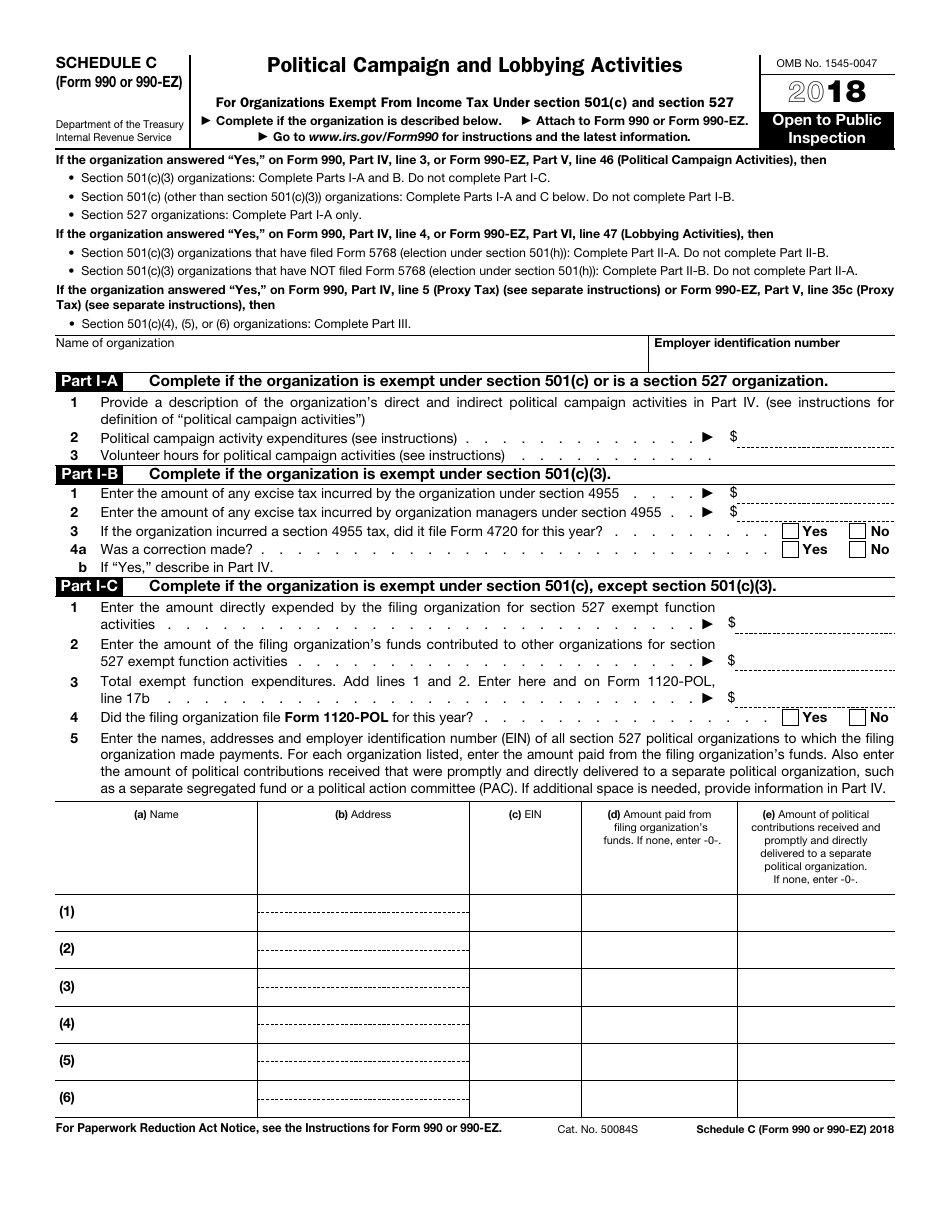

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Enter amount of tax on line 40c reimbursed by. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. On this page.

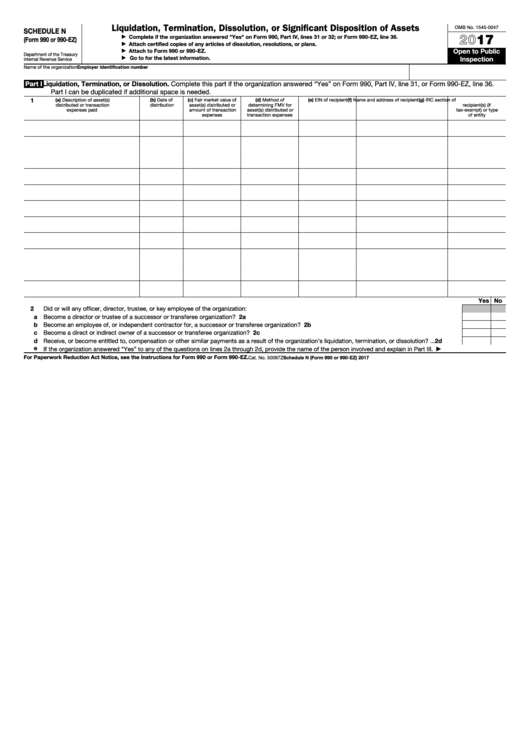

Fillable Schedule N (Form 990 Or 990Ez) Liquidation, Termination

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. The information provided will enable you to file a more complete return and reduce the chances.

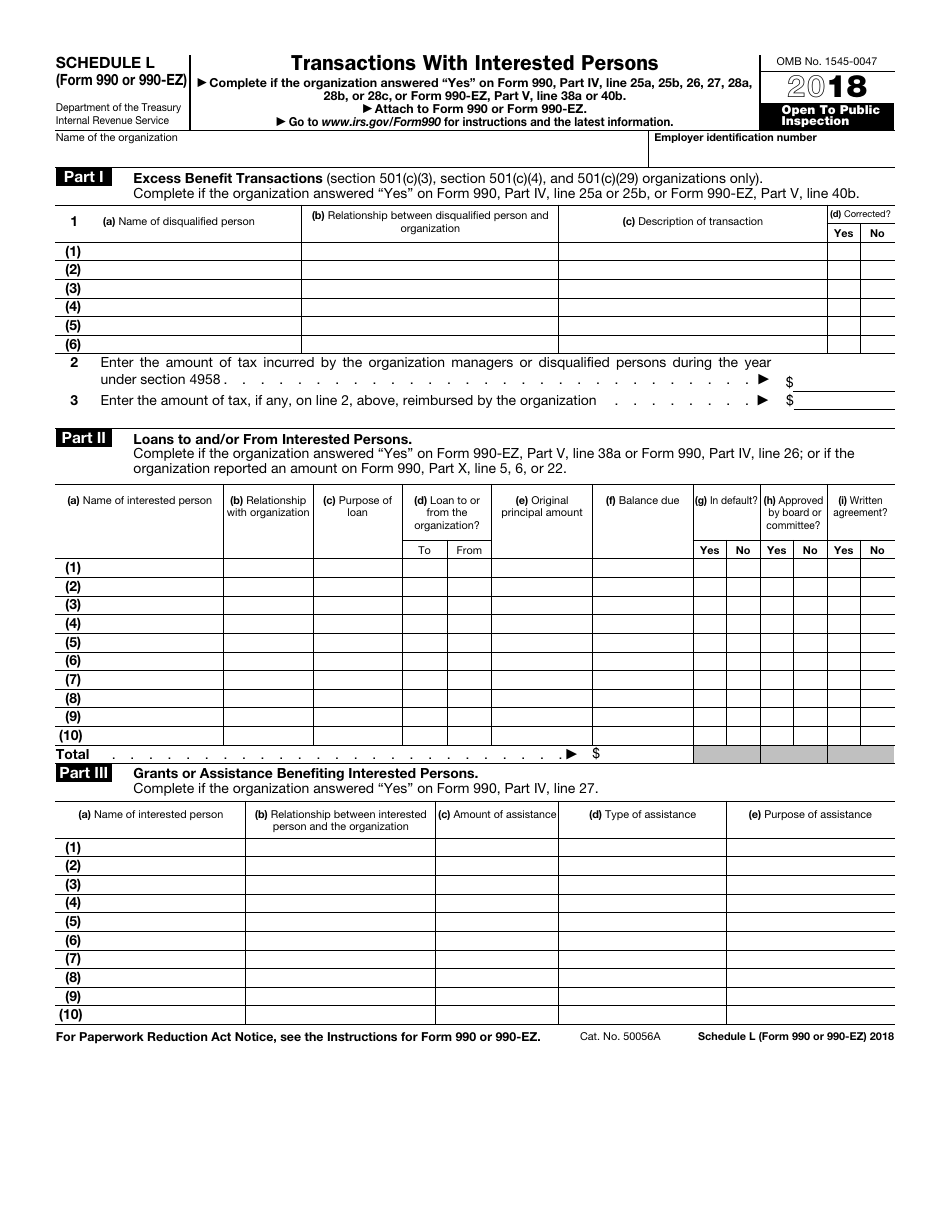

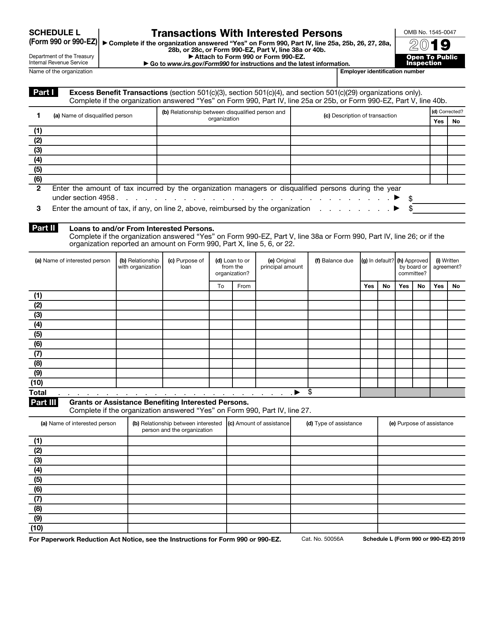

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Address change name change initial return A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. The information provided will enable you to file a more complete return and reduce.

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: On this page you may download the 990 series filings on record for 2021. Enter amount of tax on line 40c reimbursed by. This form is for income earned in tax year 2022, with tax returns due in april 2023..

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Some months may have more than one entry due to the size of the download. The download files are organized by month. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. A for the 2022 calendar year, or tax year beginning ,.

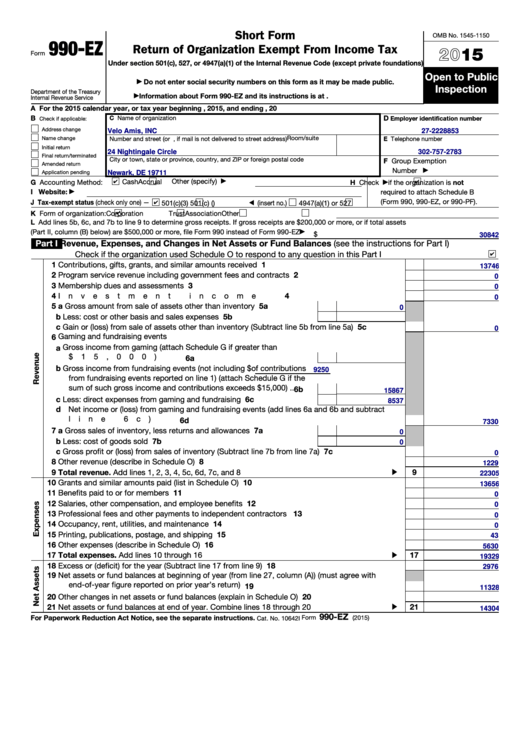

Fillable Form 990 Ez Short Form Return Of Organization Exempt From

This form is for income earned in tax year 2022, with tax returns due in april 2023. Address change name change initial return The download files are organized by month. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: Its gross receipts are normally $50,000 or less, it is.

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Some months may have more than one entry due to the size of the download. Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Some months may have more than one entry due to the size of the download. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable:

The Information Provided Will Enable You To File A More Complete Return And Reduce The Chances The Irs Will Need To Contact You.

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. On this page you may download the 990 series filings on record for 2021. Enter amount of tax on line 40c reimbursed by. Address change name change initial return