Bonds On Balance Sheet

Bonds On Balance Sheet - Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

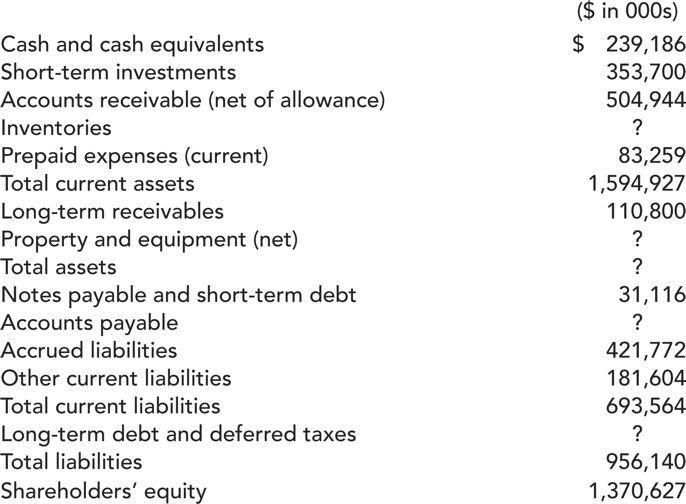

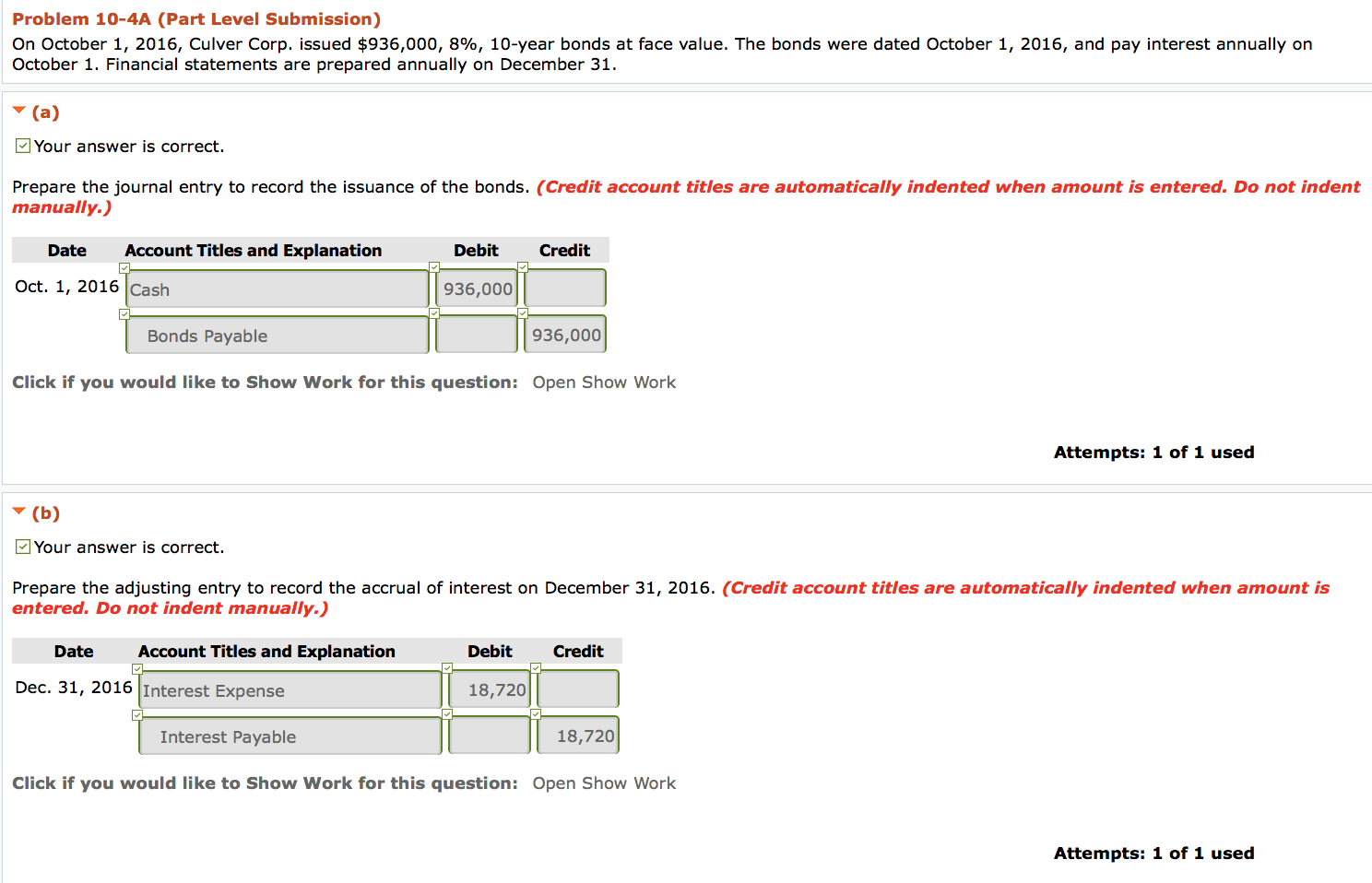

Solved Question1The following are the typical

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

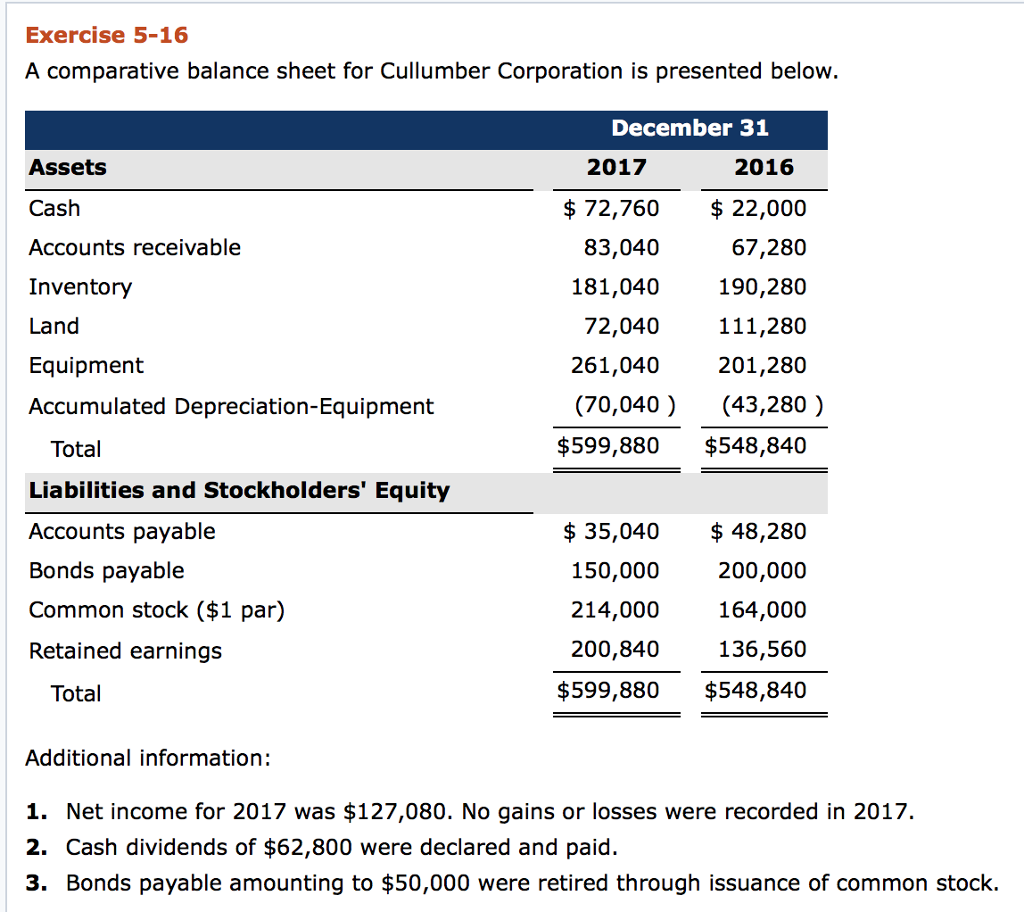

Solved Exercise 516 A comparative balance sheet for

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

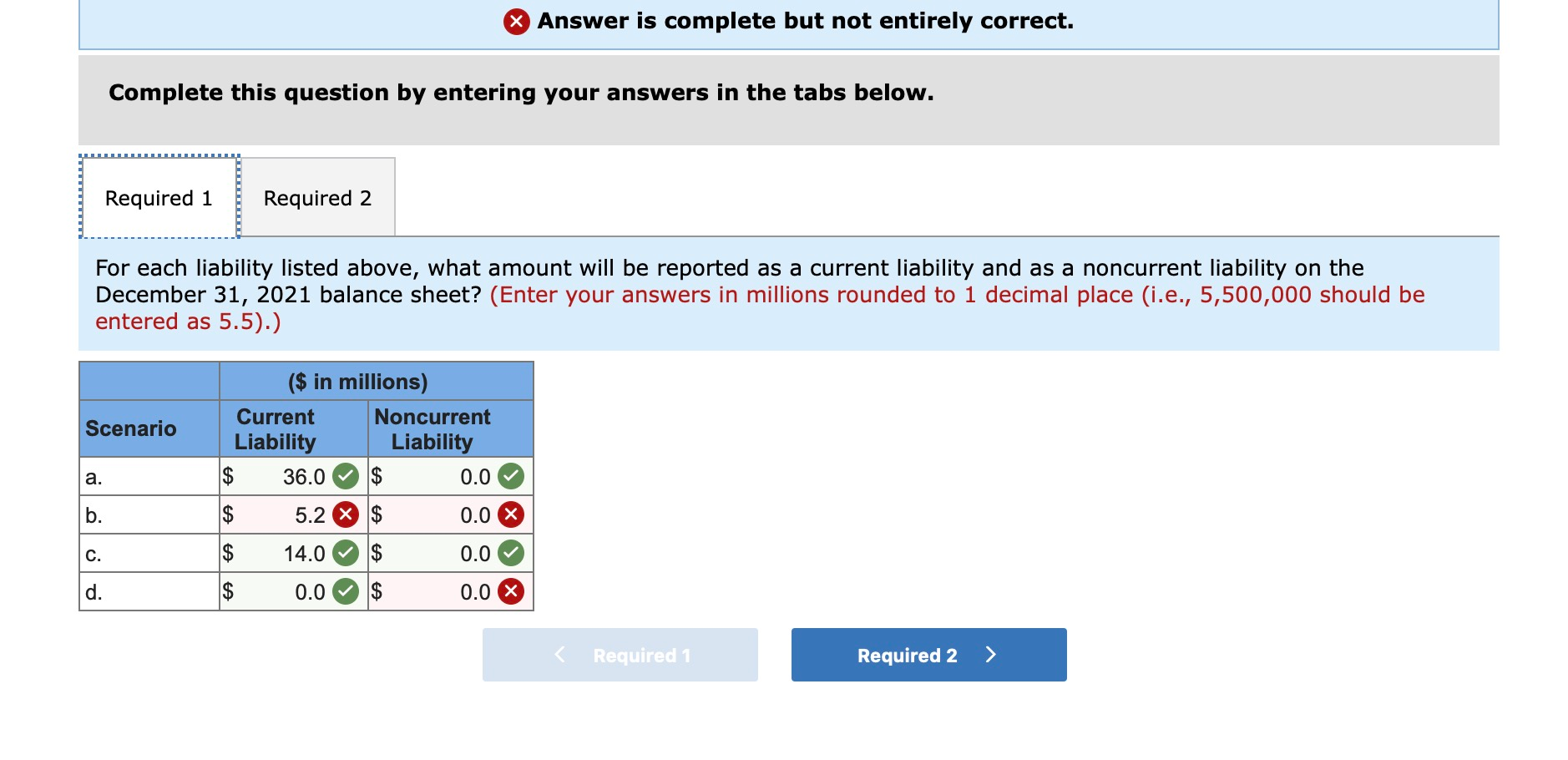

Solved The balance sheet at December 31, 2021, for Nevada

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

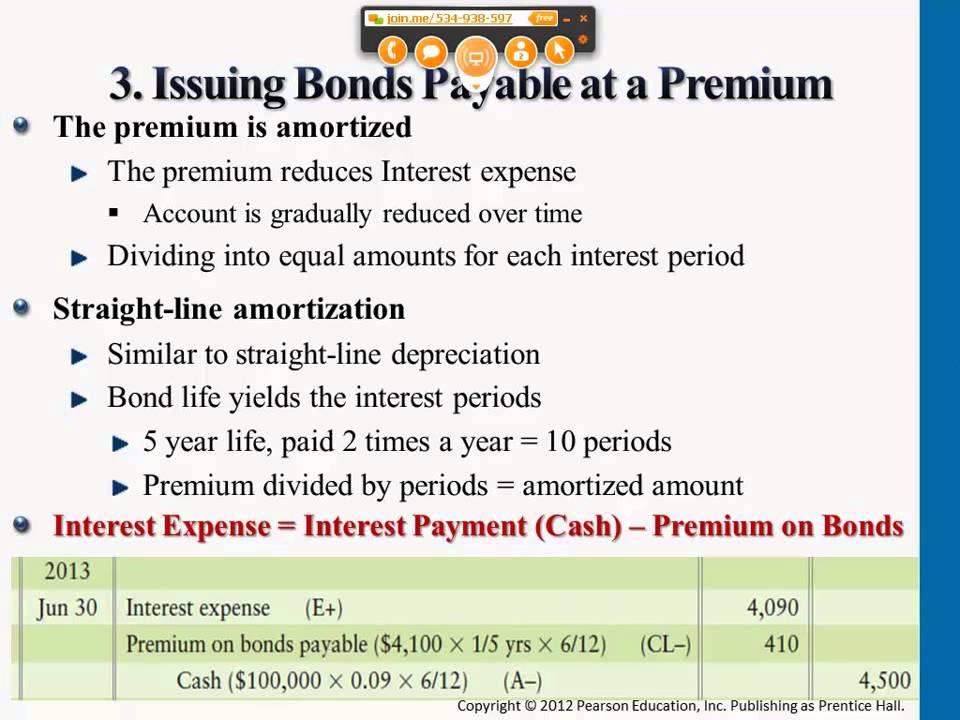

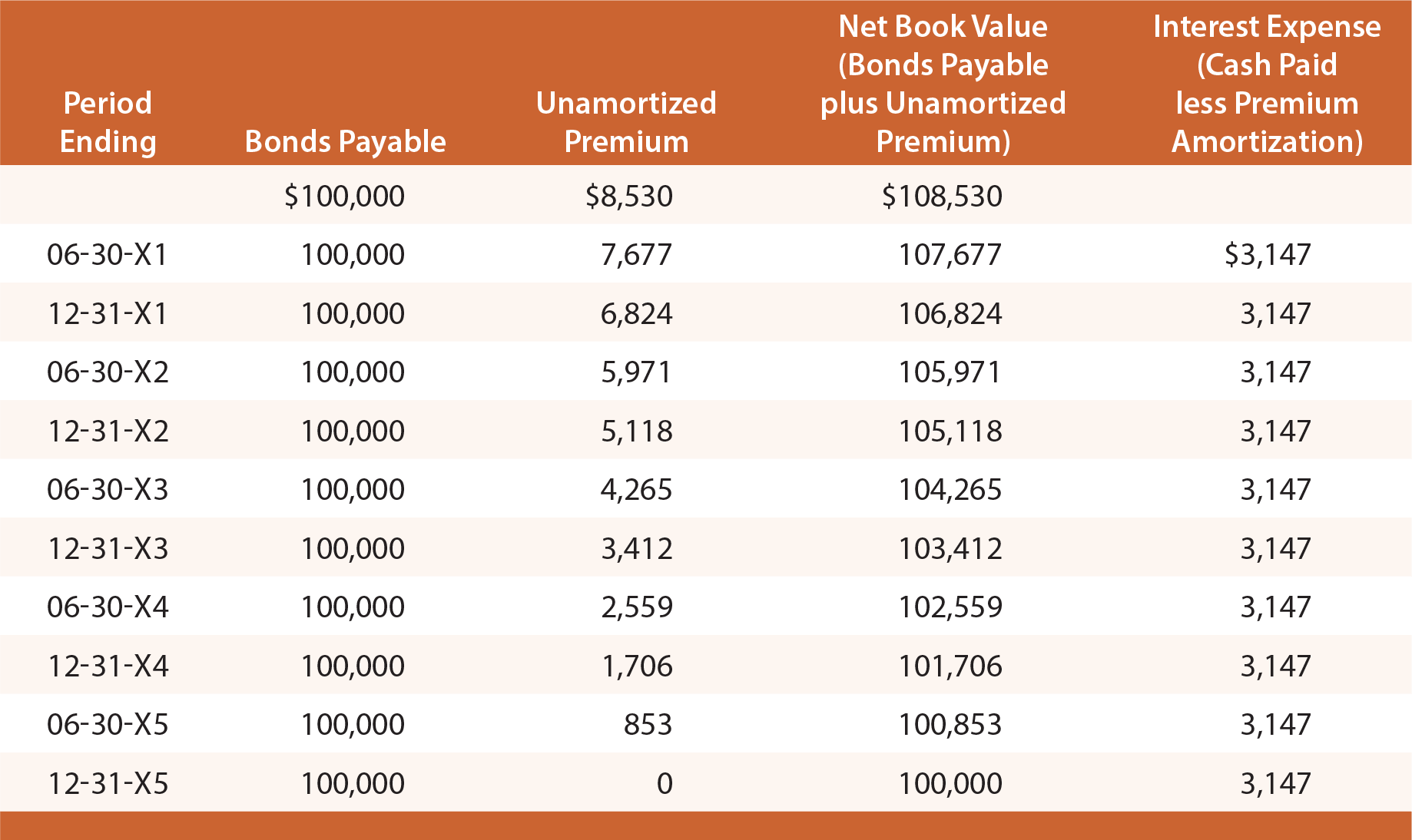

Bonds Payable at Premium Balance Sheet Presentation YouTube

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

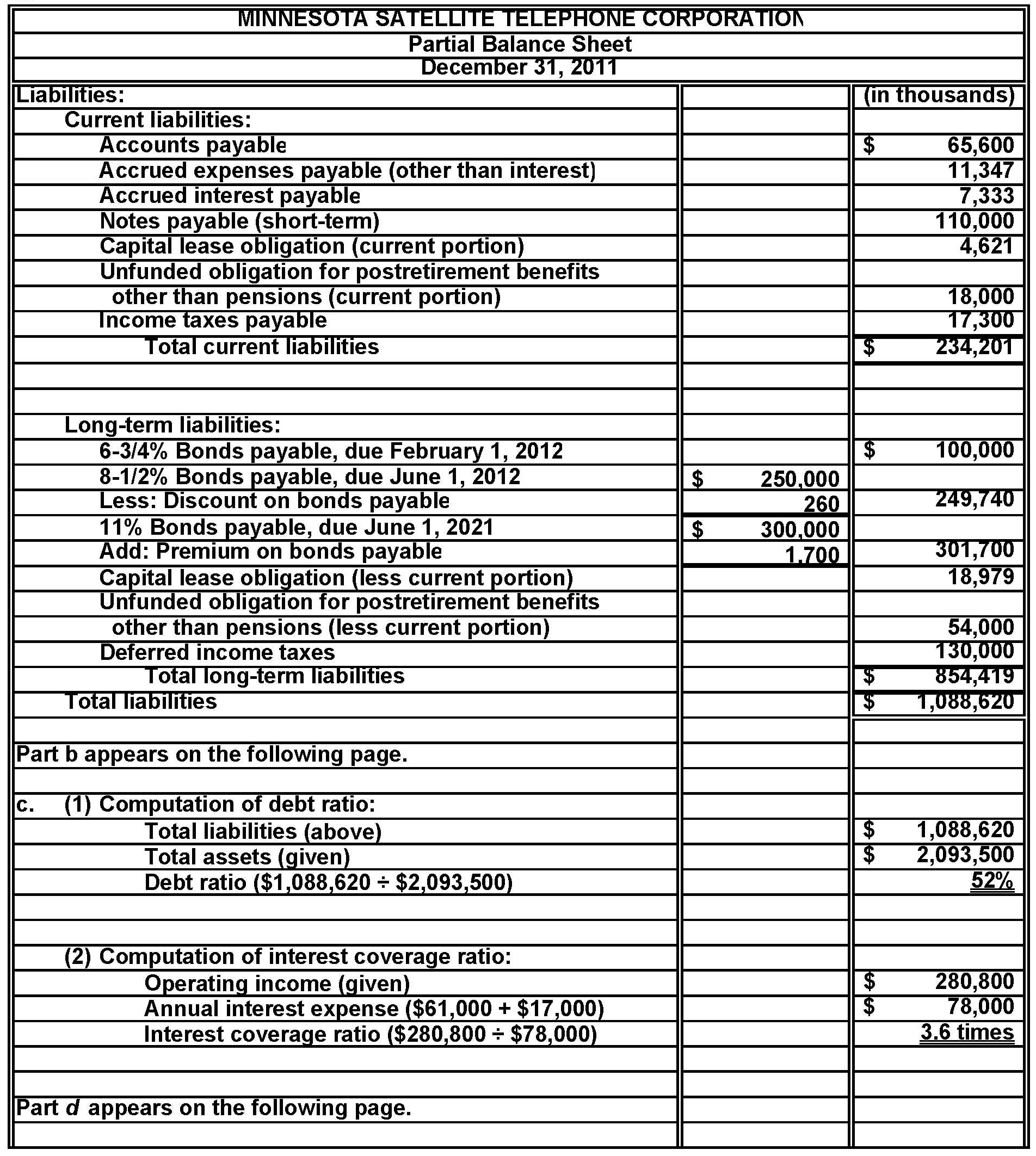

Solved (c) Your answer is correct. Show the balance sheet

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non.

Balance Sheet Definition Formula & Examples

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Accounting For Bonds Payable

Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

Bond Sinking Fund On Balance Sheet amulette

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

Bonds Payable Formula + Calculation

Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

Important Radioactif Sûr balance sheet items examples en relation Mise

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Web The Income Statement For Each Of The 10 Years Would Show Bond Interest Expense Of $12,000 ($ 6,000 X 2 Payments Per Year);.

Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)