Cp2000 Response Letter Template

Cp2000 Response Letter Template - Web respond to the notice. Send your response to the notice within 30 days of the date on the notice. Web you have two options on how you can respond to a cp2000 notice. If it is correct and you excluded a source of. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Response to cp2000 notice dated month, xx, year.

Send your response to the notice within 30 days of the date on the notice. If it is correct and you excluded a source of. Response to cp2000 notice dated month, xx, year. Web you have two options on how you can respond to a cp2000 notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Web respond to the notice.

Send your response to the notice within 30 days of the date on the notice. Response to cp2000 notice dated month, xx, year. If it is correct and you excluded a source of. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Web you have two options on how you can respond to a cp2000 notice. Web respond to the notice.

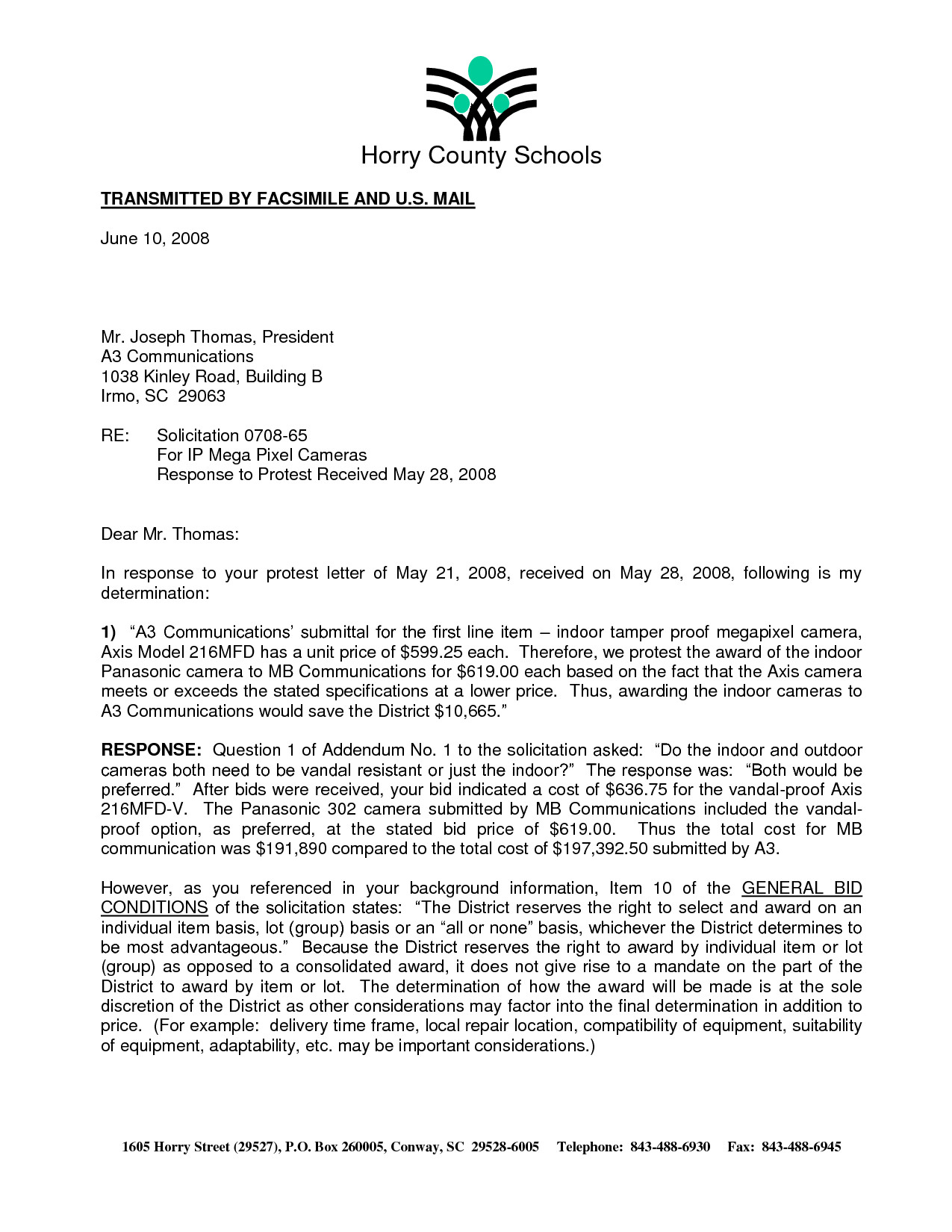

Cp2000 Response Letter Template Samples Letter Template Collection

Web you have two options on how you can respond to a cp2000 notice. Send your response to the notice within 30 days of the date on the notice. If it is correct and you excluded a source of. Response to cp2000 notice dated month, xx, year. Web a cp2000 notice is an underreporter inquiry that gets issued when the.

Irs Cp2000 Example Response Letter amulette

Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Send your response to the notice within 30 days of the date on the notice. Response to cp2000 notice dated month, xx, year. Web respond to the notice. Web you have two options on how you can respond to a cp2000.

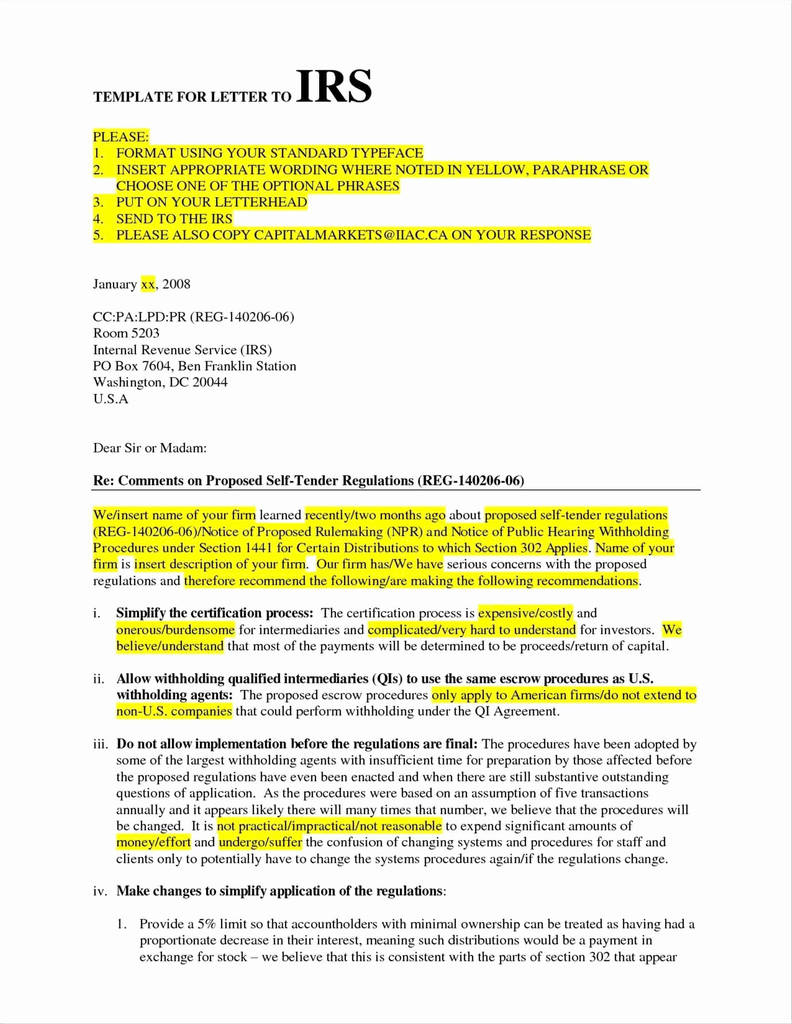

Irs Cp2000 Response Form Pdf Lovely Ss 4 Irs Notification With Irs

Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Web you have two options on how you can respond to a cp2000 notice. If it is correct and you excluded a source of. Web respond to the notice. Send your response to the notice within 30 days of the date.

Cp2000 Response Letter Template

Send your response to the notice within 30 days of the date on the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Web respond to the notice. If it is correct and you excluded a source of. Web you have two options on how you can respond to.

Irs Cp2000 Response Letter Sample

Web respond to the notice. Web you have two options on how you can respond to a cp2000 notice. Send your response to the notice within 30 days of the date on the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. If it is correct and you excluded.

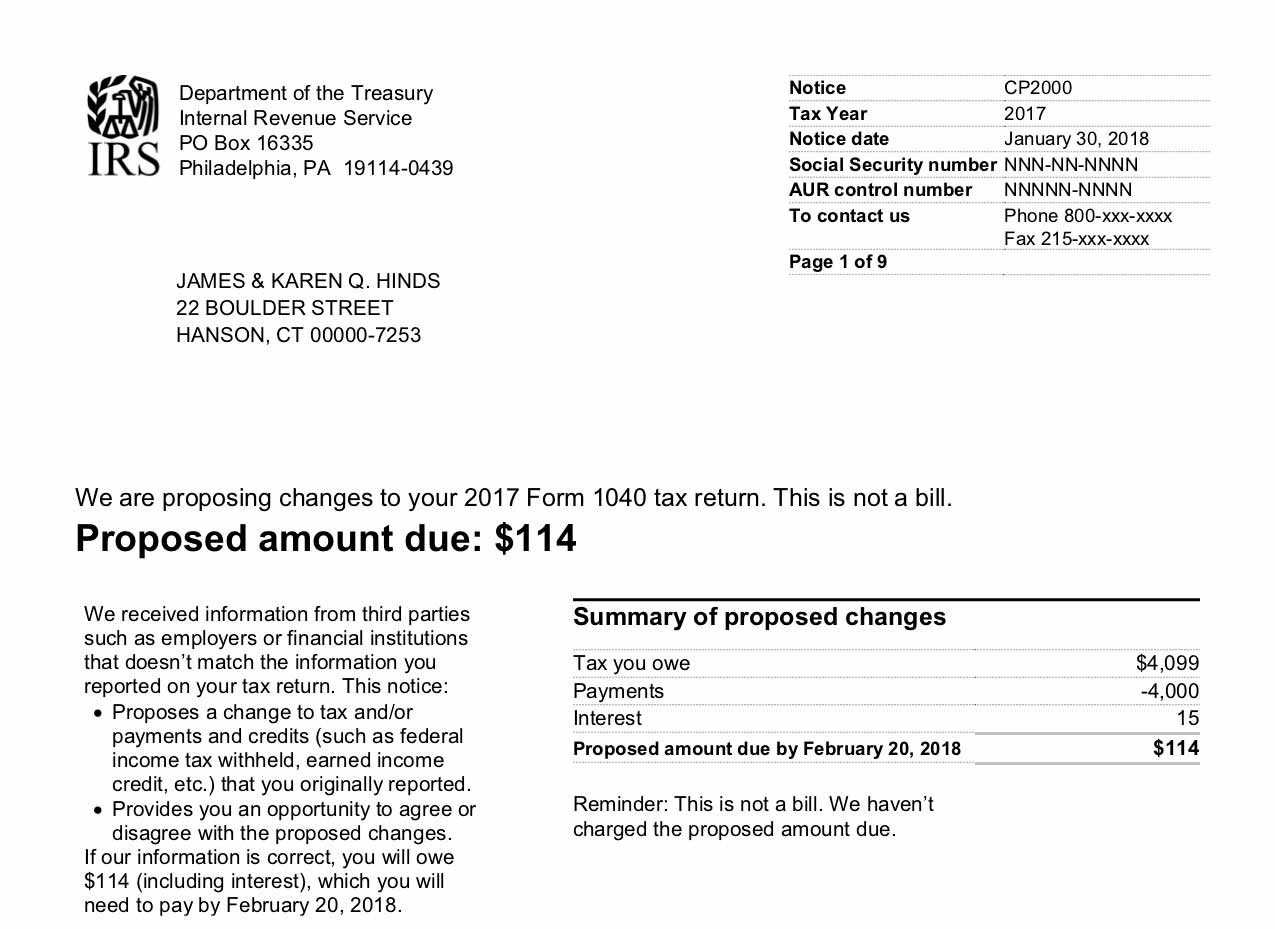

IRS Audit Letter CP2000 Sample 4

Web you have two options on how you can respond to a cp2000 notice. If it is correct and you excluded a source of. Response to cp2000 notice dated month, xx, year. Web respond to the notice. Send your response to the notice within 30 days of the date on the notice.

Irs Cp2000 Example Response Letter amulette

If it is correct and you excluded a source of. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Response to cp2000 notice dated month, xx, year. Web respond to the notice. Web you have two options on how you can respond to a cp2000 notice.

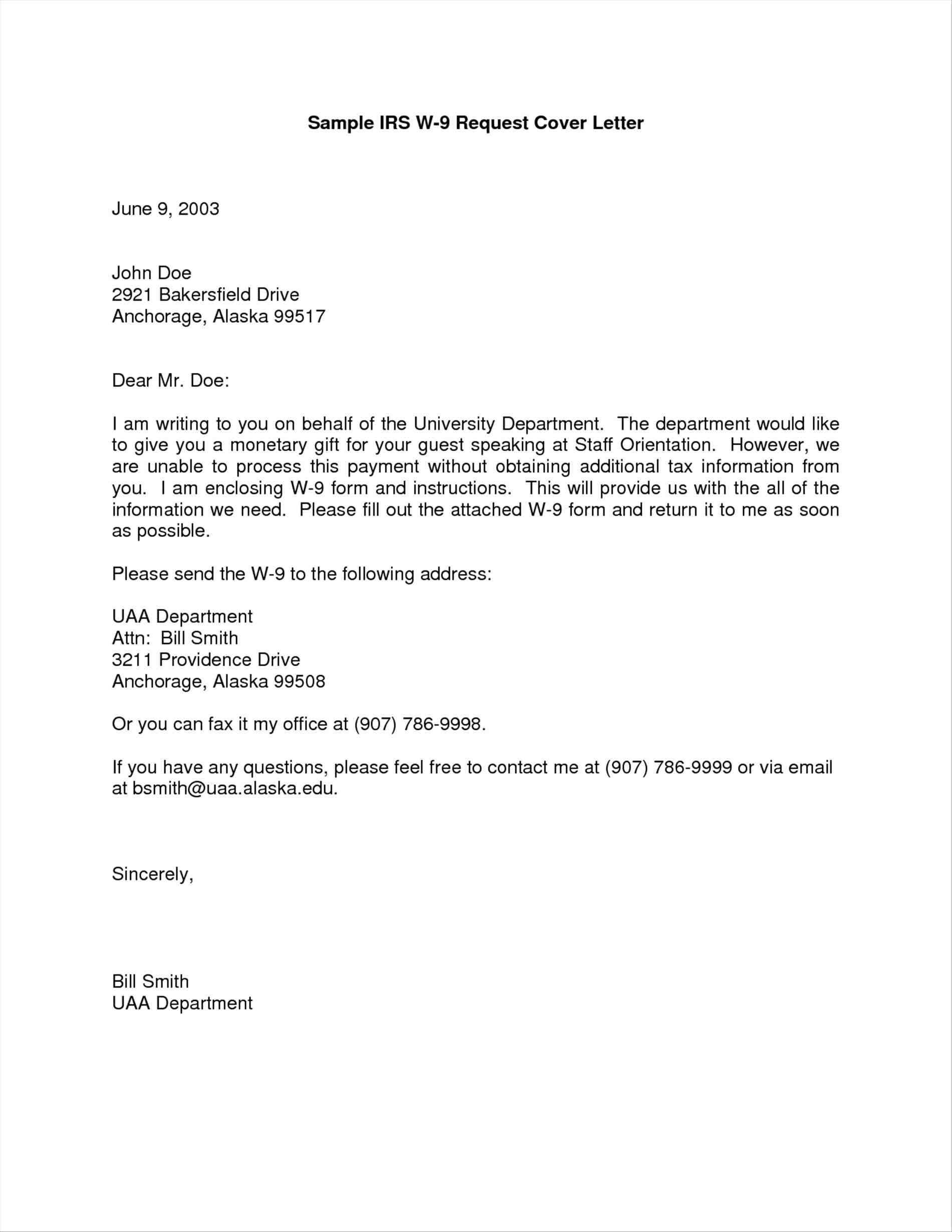

Cp2000 Response Letter Sample

Response to cp2000 notice dated month, xx, year. If it is correct and you excluded a source of. Web respond to the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. Send your response to the notice within 30 days of the date on the notice.

Irs Cp2000 Example Response Letter amulette

Web you have two options on how you can respond to a cp2000 notice. Web respond to the notice. Response to cp2000 notice dated month, xx, year. Send your response to the notice within 30 days of the date on the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not.

Cp2000 Response Letter Template Samples Letter Template Collection

Web respond to the notice. Response to cp2000 notice dated month, xx, year. Send your response to the notice within 30 days of the date on the notice. Web you have two options on how you can respond to a cp2000 notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not.

Web You Have Two Options On How You Can Respond To A Cp2000 Notice.

Response to cp2000 notice dated month, xx, year. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. If it is correct and you excluded a source of. Send your response to the notice within 30 days of the date on the notice.