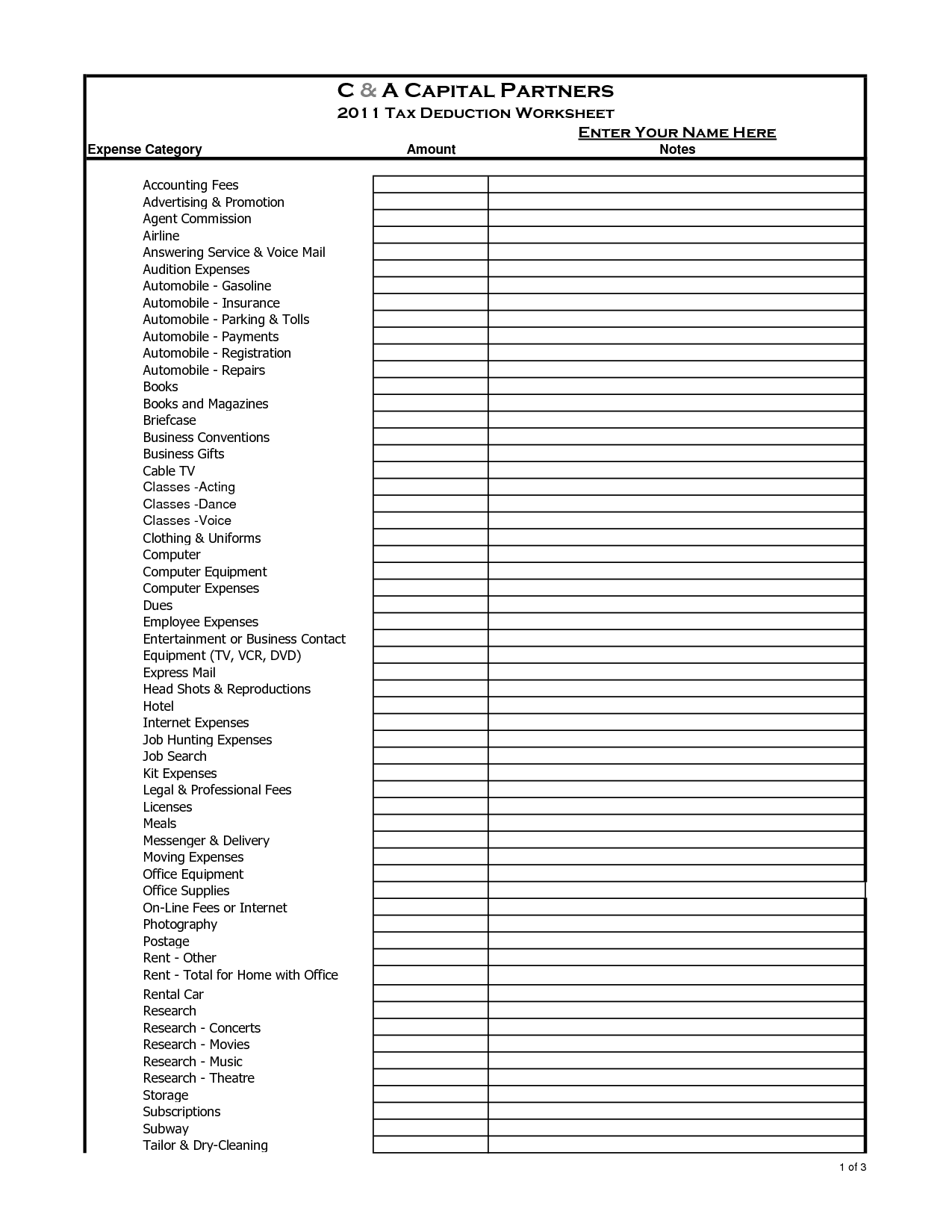

Free Printable Tax Deduction Worksheet

Free Printable Tax Deduction Worksheet - The source information that is required for each tax. If yes, fill out worksheet on page 3. Did your children attend private elementary or high school in wi? You filed form 4361, but you had $400 or more. If you are a minister, member of a religious order, or christian science practitioner. Did you or any of your dependents have education expenses? Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Getting to write off your housing costs. Web use the following tax deduction checklist when filing your annual return: Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes.

Did you pay anyone for childcare expenses? Web retain this worksheet with your receipts in your tax file. Church employee income, see instructions for how to report your income and the definition of church employee income. A donor is responsible for. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. Jan 13, 2022 — instructions: Web printable tax documentation checklist. Web use the following tax deduction checklist when filing your annual return: Web to download the free rental income and expense worksheet template, click the green button at the top of the page.

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you. Web printable tax deduction worksheet. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Web click here for information on the history, background or why this worksheet came to be. If you are a minister, member of a religious order, or christian science practitioner. You filed form 4361, but you had $400 or more. Use this worksheet to figure the amount, if any, of your. Web use the following tax deduction checklist when filing your annual return: Did your children attend private elementary or high school in wi? Getting to write off your housing costs.

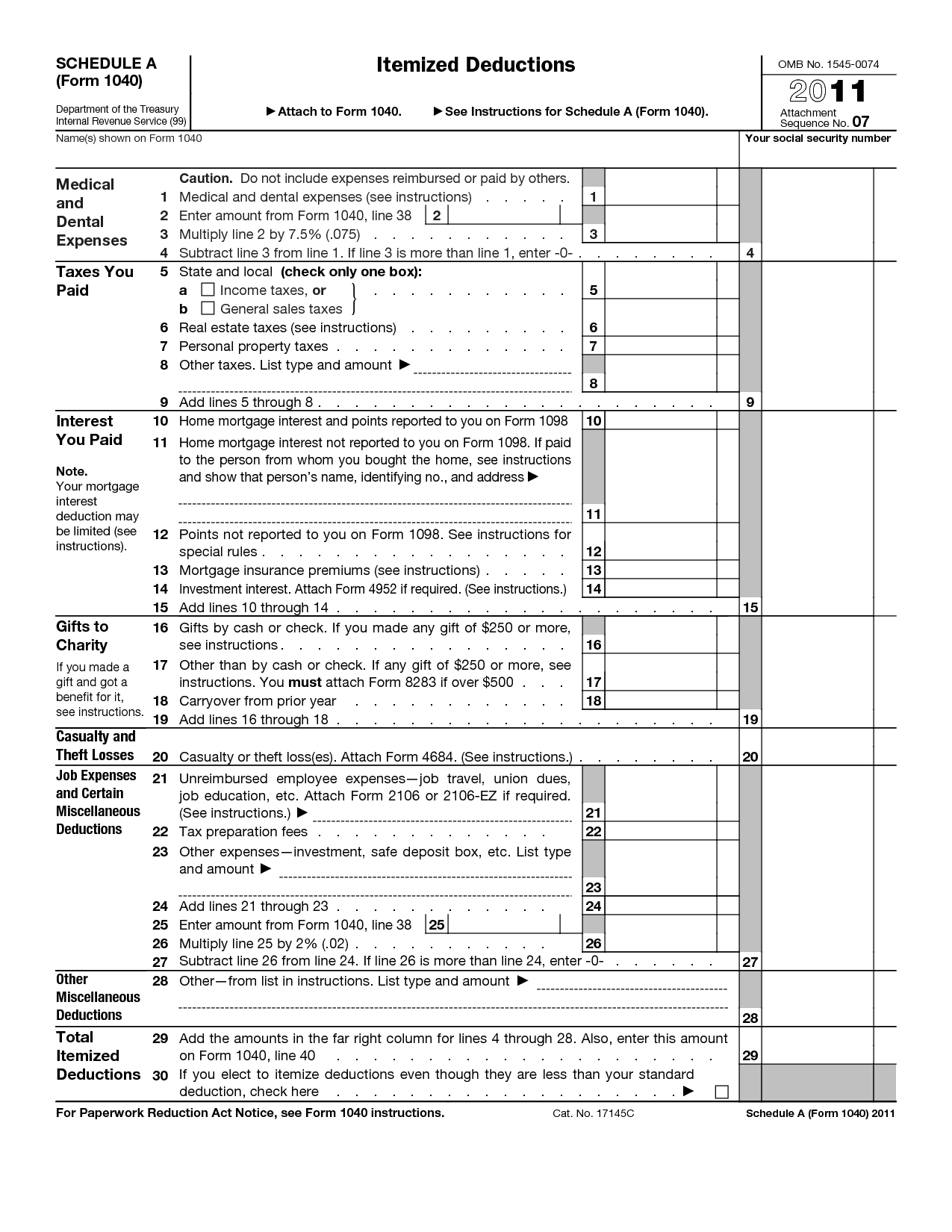

Itemized Tax Deduction Worksheet

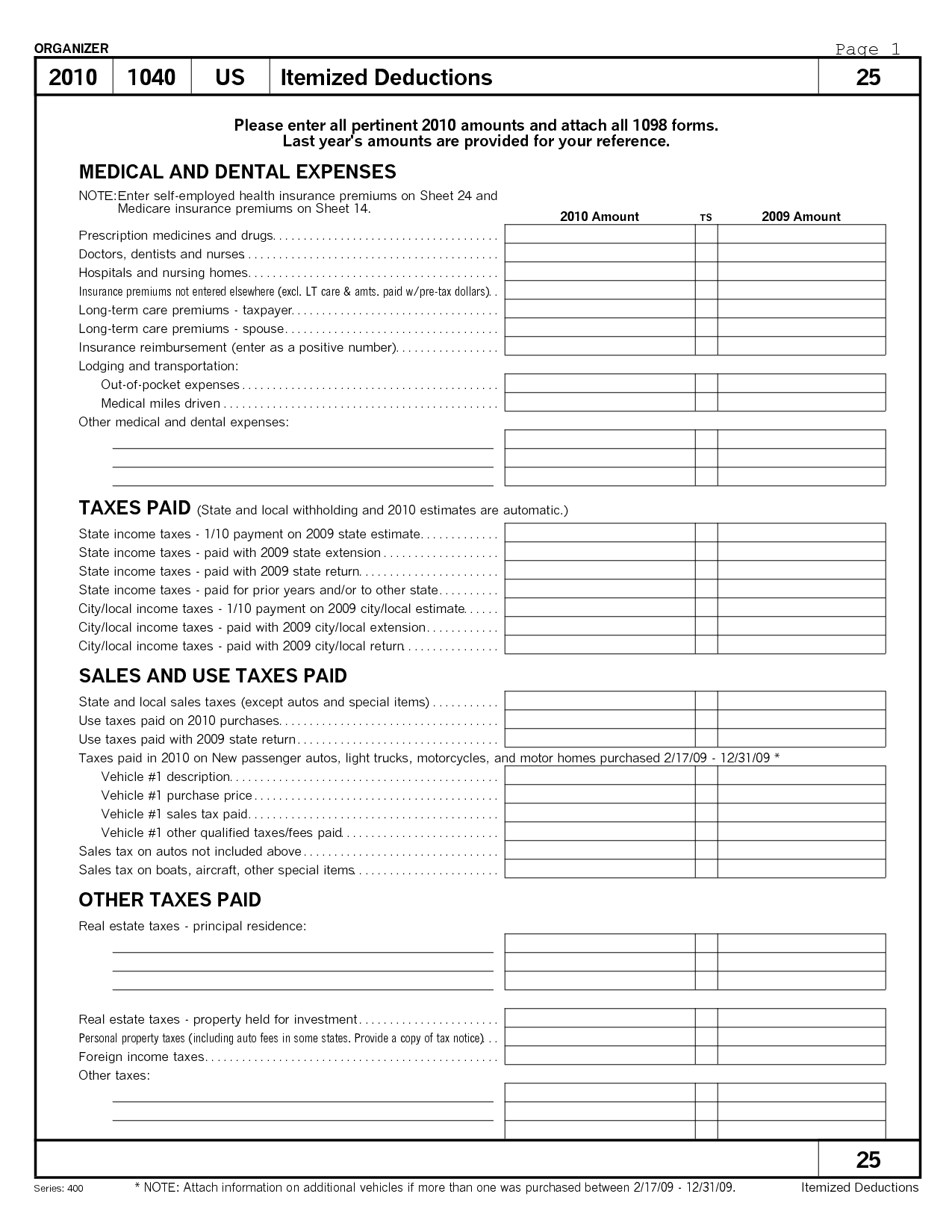

Web farm worksheet december 31, 2022 farm income 2022 page 1 description of property quantity sale price cattle hogs. The source information that is required for each tax. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Church employee income, see instructions for how to report your income and the definition of.

Tax De Trucker Tax Deduction Worksheet Great Linear —

Web retain this worksheet with your receipts in your tax file. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web farm worksheet december 31, 2022 farm income 2022 page 1 description of property quantity sale price cattle hogs. Web do you have any dependents that you are claiming? Track your rental.

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Web do you have any dependents that you are claiming? Did you pay anyone for childcare expenses? Your receipts should include a reasonably accurate likewise, if one made donations to four separate entities, a. The source information that is required for each tax. Use this worksheet to figure the amount, if any, of your.

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable

A donor is responsible for. Web retain this worksheet with your receipts in your tax file. Jan 13, 2022 — instructions: Getting to write off your housing costs. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the.

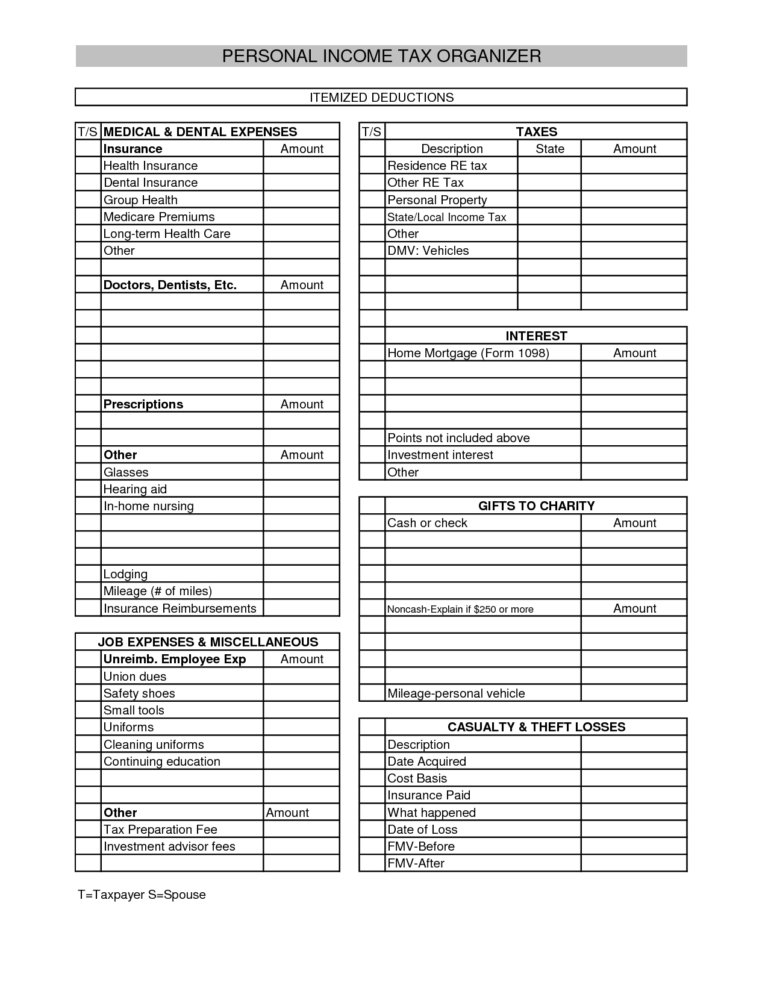

8 Best Images of Tax Preparation Organizer Worksheet Individual

Publication 502 (2021), medical and dental expenses. If yes, fill out worksheet on pg 3. Web printable tax documentation checklist. Church employee income, see instructions for how to report your income and the definition of church employee income. General taxable income ___ alimony received or paid ___ dividend income statements:

Small Business Tax Deductions Worksheet

Web to download the free rental income and expense worksheet template, click the green button at the top of the page. General taxable income ___ alimony received or paid ___ dividend income statements: Jan 13, 2022 — instructions: If yes, fill out worksheet on page 3. Web these free printable tax deduction worksheets can be customized to fit the needs.

Printable Tax Deduction Worksheet —

If yes, fill out worksheet on page 3. If yes, fill out worksheet on page 3. You filed form 4361, but you had $400 or more. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense”.

8 Best Images of Monthly Bill Worksheet 2015 Itemized Tax Deduction

Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. General taxable income ___ alimony received or paid ___ dividend income statements: Use this worksheet to figure the amount, if any, of your. Jan 13, 2022 — instructions: If you are a minister, member of a religious order, or christian science practitioner.

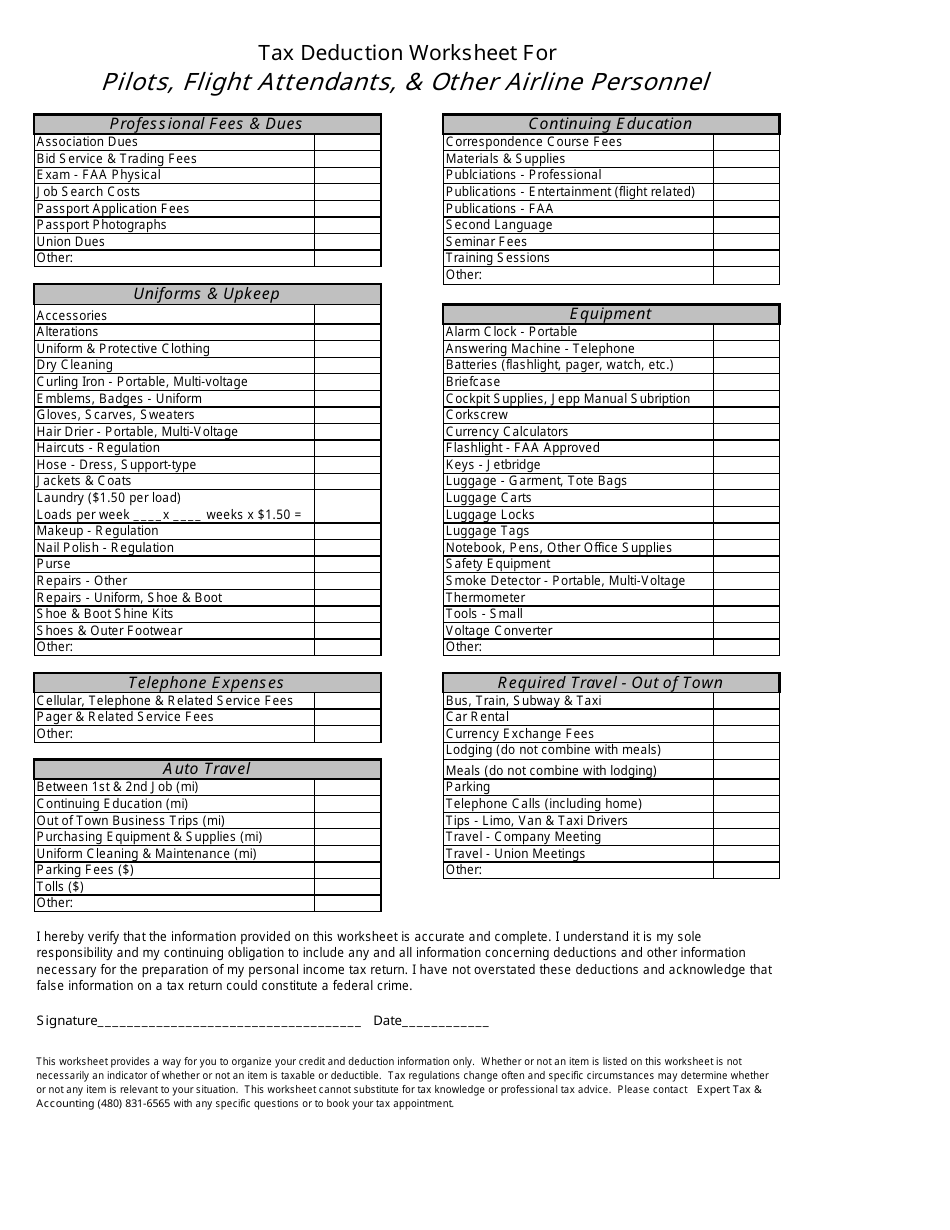

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline

Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. General taxable income ___ alimony received or paid ___ dividend income statements: Web a goodwill donation receipt is used to claim a tax deduction for.

Self Employed Tax Deductions Worksheet Form Fill Out and Sign

Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. The source information that is required for each tax. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Track your rental finances by entering the relevant amounts into.

Web Compile Information For Your Individual Tax Return With Ease Using Our 2022 Tax Organizer And Spreadsheets.

General taxable income ___ alimony received or paid ___ dividend income statements: Click to print personal tax preparation checklist for individuals. Web these free printable tax deduction worksheets can be customized to fit the needs of the individual trainee or classroom, and can be utilized as a supplement to conventional class direction or for extracurricular activities and also rate of interests. Getting to write off your housing costs.

Web To Download The Free Rental Income And Expense Worksheet Template, Click The Green Button At The Top Of The Page.

Web click here for information on the history, background or why this worksheet came to be. Did you pay anyone for childcare expenses? Did you or any of your dependents have education expenses? Web farm worksheet december 31, 2022 farm income 2022 page 1 description of property quantity sale price cattle hogs.

Your Receipts Should Include A Reasonably Accurate Likewise, If One Made Donations To Four Separate Entities, A.

Web printable tax documentation checklist. Church employee income, see instructions for how to report your income and the definition of church employee income. If yes, fill out worksheet on page 3. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes.

Publication 502 (2021), Medical And Dental Expenses.

Web do you have any dependents that you are claiming? You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you. Web use the following tax deduction checklist when filing your annual return: A donor is responsible for.