Interest Expense Balance Sheet

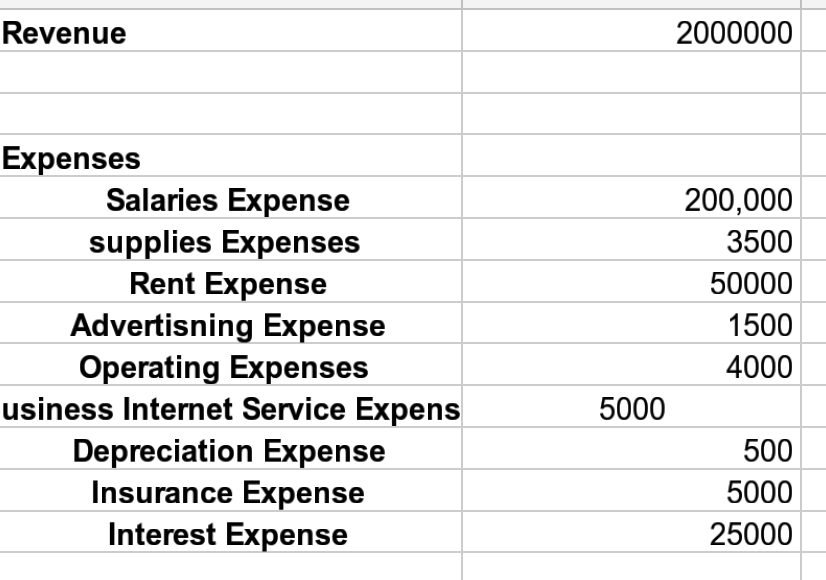

Interest Expense Balance Sheet - Lenders list accrued interest as revenue. Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement: An interest expense is the cost incurred by an entity for borrowed funds. Web the formula is: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Interest expense = average balance of debt obligation x interest rate. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web the accounting treatment of interest expense is as follows:

Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Here is the formula to calculate interest on the income statement: Interest expense = average balance of debt obligation x interest rate. Web the accounting treatment of interest expense is as follows: An interest expense is the cost incurred by an entity for borrowed funds. Lenders list accrued interest as revenue. Web the formula is: Web suzanne kvilhaug what is an interest expense? Income statement (i/s) → on the income statement, interest expense impacts the earnings before.

Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. An interest expense is the cost incurred by an entity for borrowed funds. Interest expense = average balance of debt obligation x interest rate. Lenders list accrued interest as revenue. Web the formula is: Web the accounting treatment of interest expense is as follows:

How To Calculate Employee Benefit Expense

Interest expense = average balance of debt obligation x interest rate. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web the accounting treatment of interest expense is as follows: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. An interest expense is.

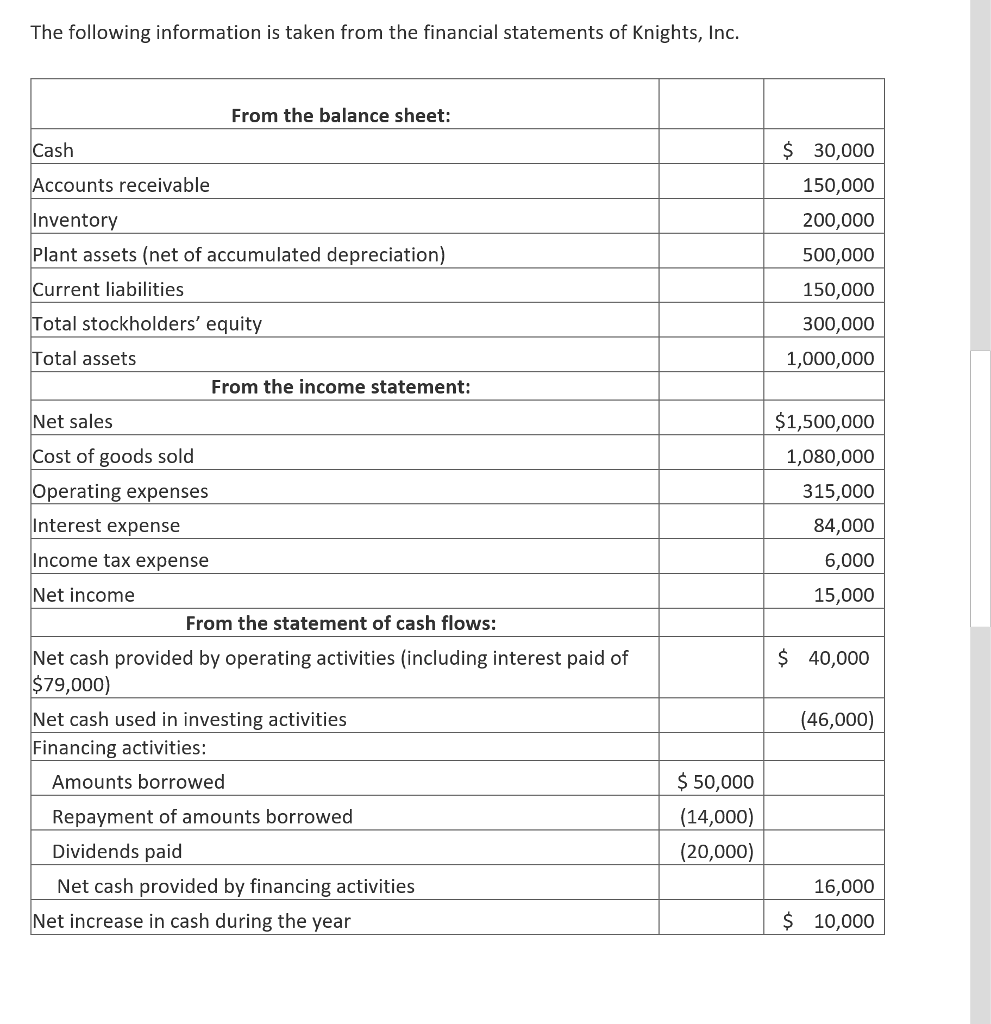

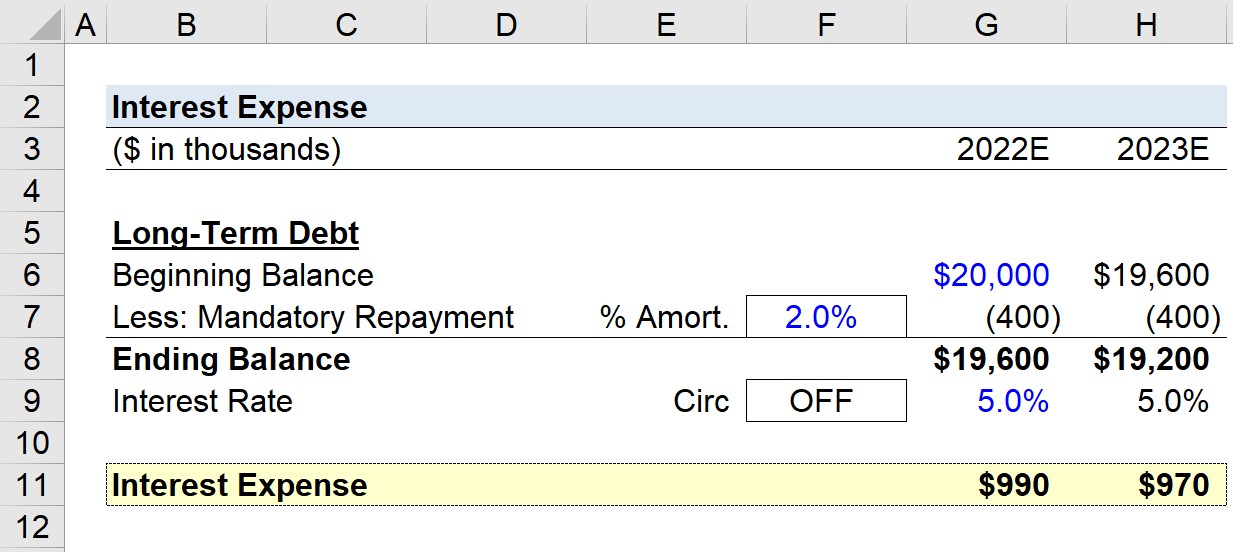

Solved Explain how the interest expense shown in the

Web suzanne kvilhaug what is an interest expense? Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Web borrowers list accrued interest as an expense on the income statement and a current liability on.

33+ Expense Sheet Templates

Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. An interest expense is the cost incurred by an entity for borrowed funds. Web the formula is:

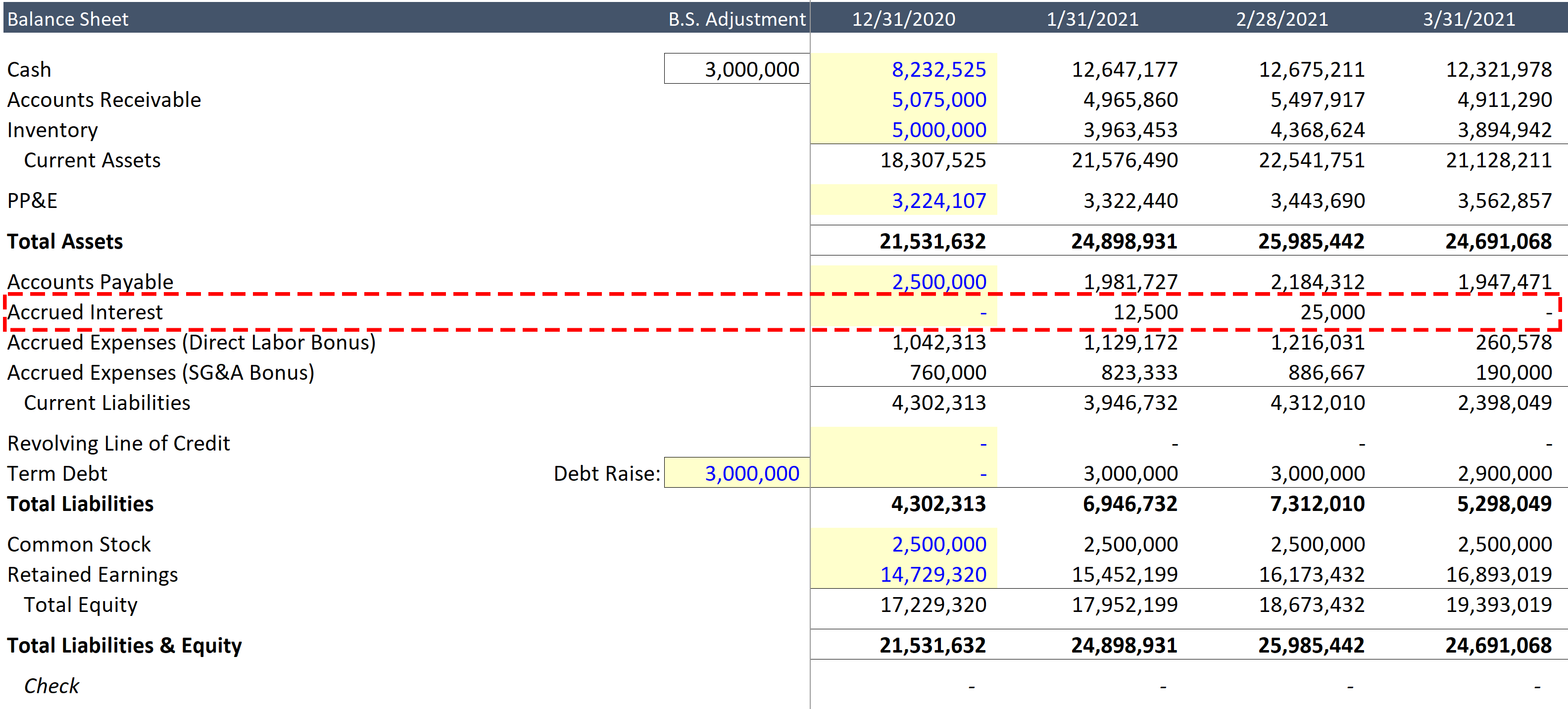

Balance Sheet Highlights 19

Web suzanne kvilhaug what is an interest expense? Web the accounting treatment of interest expense is as follows: Here is the formula to calculate interest on the income statement: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. An interest expense is the cost incurred by an entity for borrowed funds.

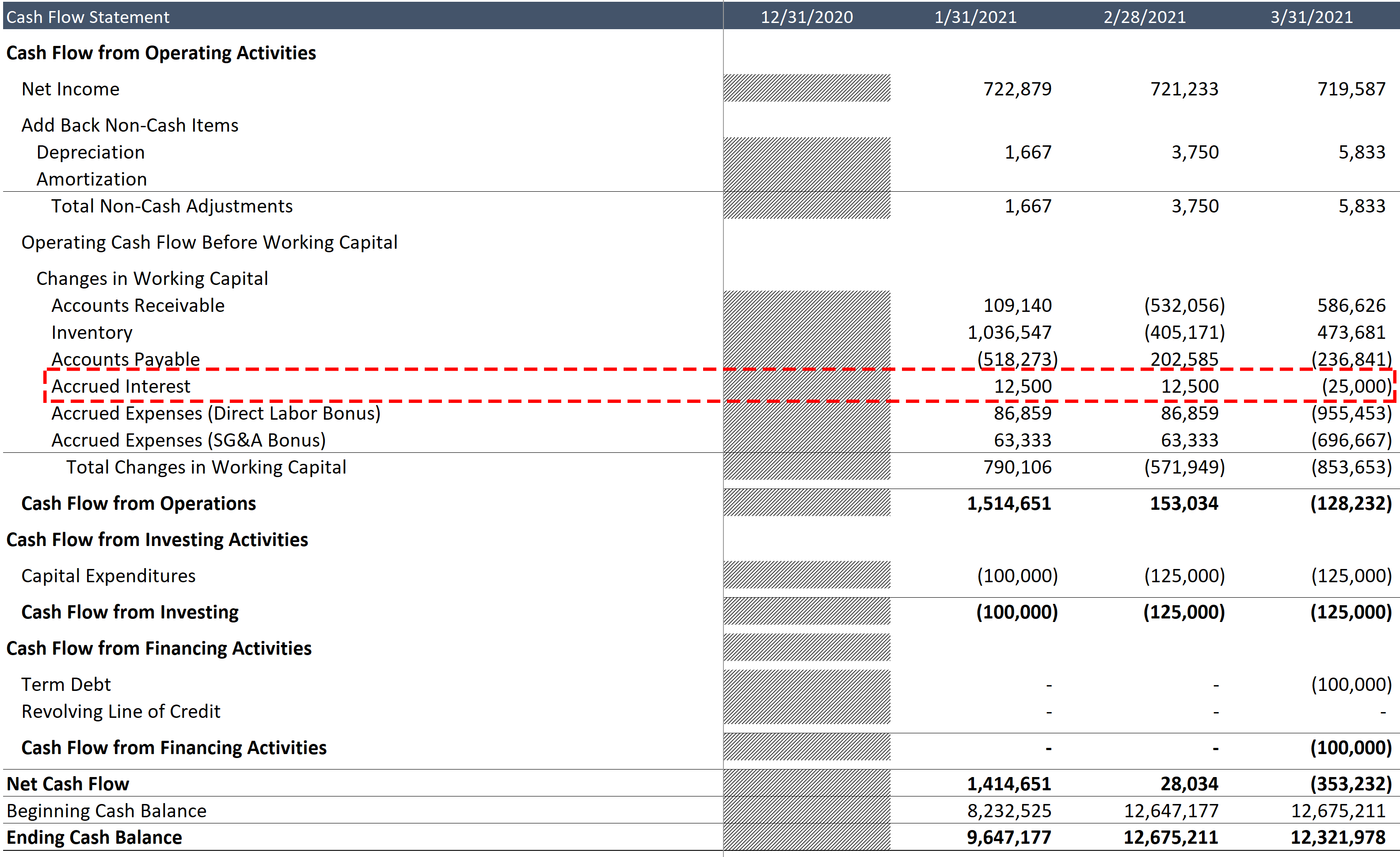

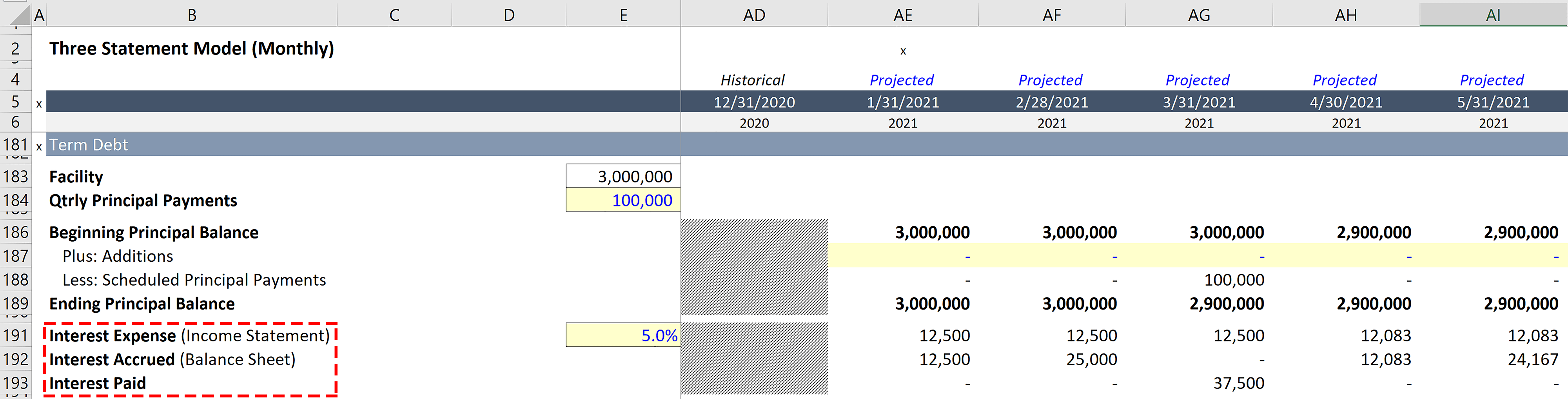

Interest Expense in a Monthly Financial Model (Cash Interest vs

Web the formula is: Here is the formula to calculate interest on the income statement: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Interest expense = average balance of debt obligation x interest rate. Web suzanne kvilhaug what is an interest expense?

Interest Expense in a Monthly Financial Model (Cash Interest vs

Web the formula is: Web the accounting treatment of interest expense is as follows: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement:

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense = average balance of debt obligation x interest rate. Web the accounting treatment of interest expense is as follows: Web the formula is: Web suzanne kvilhaug what is an interest expense? Lenders list accrued interest as revenue.

Interest Expense Formula and Calculator

Web the formula is: Interest expense = average balance of debt obligation x interest rate. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web suzanne kvilhaug what is an interest expense? An interest expense is the cost incurred by an entity for borrowed funds.

Interest Expenses How They Work, Coverage Ratio Explained / FASB Topic

Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Lenders list accrued interest as revenue. Web the formula is: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web borrowers list accrued interest as an expense on the income statement and a current.

Interest Expense Formula and Calculator

Lenders list accrued interest as revenue. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Here is the formula to calculate interest on the income statement: An interest expense is the cost incurred by an entity for borrowed funds. Web borrowers list accrued interest as an expense on the income statement and a current liability.

Lenders List Accrued Interest As Revenue.

Here is the formula to calculate interest on the income statement: Interest expense = average balance of debt obligation x interest rate. An interest expense is the cost incurred by an entity for borrowed funds. Web suzanne kvilhaug what is an interest expense?

Income Statement (I/S) → On The Income Statement, Interest Expense Impacts The Earnings Before.

Web the formula is: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web the accounting treatment of interest expense is as follows: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet.

:max_bytes(150000):strip_icc()/interestexpense.asp_final-97773a4d154444b4a5fb30fbbae4102d.png)