Printable Credit Card Convenience Fee Sign

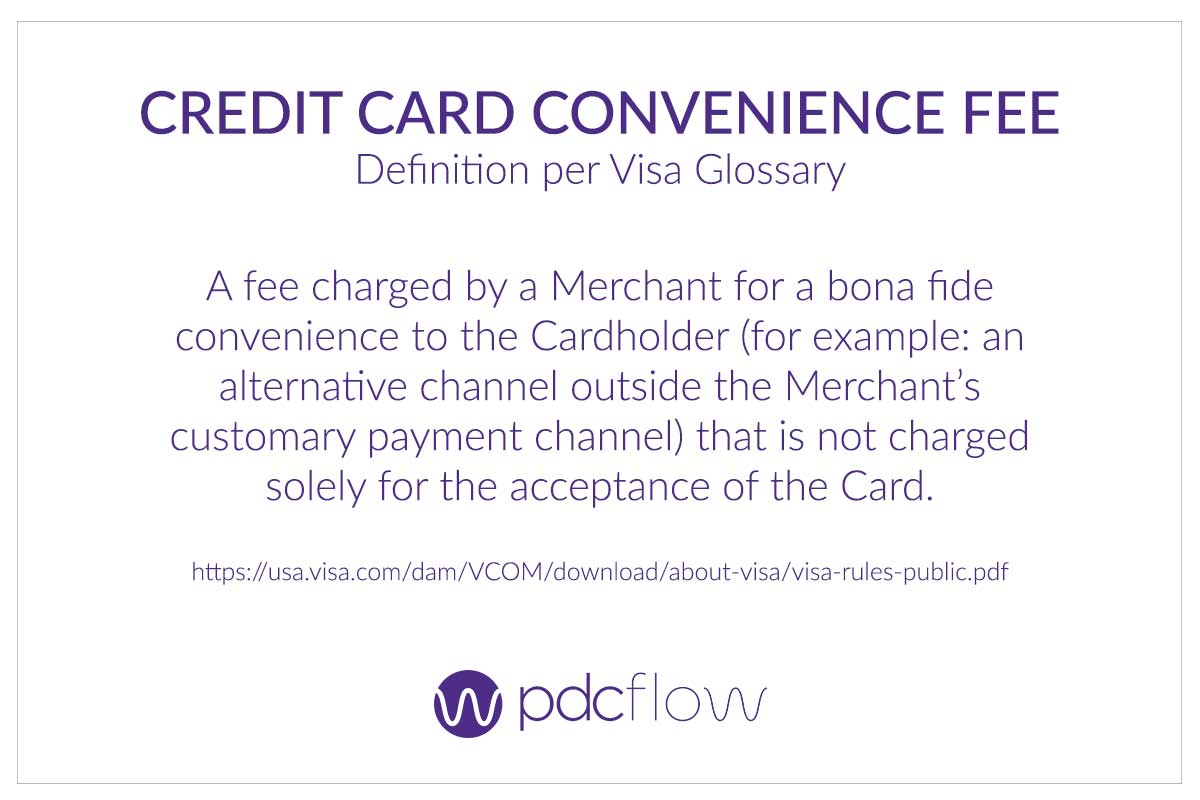

Printable Credit Card Convenience Fee Sign - What are credit card convenience fees? Web different types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Web subscribe to the free printable newsletter. Web a surcharge over 4% of the purchase price is illegal and any surcharges are illegal in 10 of the 50 states — california, colorado, connecticut, florida, kansas, maine, massachusetts, new york,. The free version is available in.pdf format: For merchants that take credit card payments frequently, such as a grocery store, this fee is. Participants in the program will be permitted to assess a convenience fee for mastercard transactions, whether conducted in person, internet, phone, mail or kiosk, versus other forms of The $3.99 version can be edited. A convenience fee is a fee that a merchant charges a customer for paying in a manner that’s not standard for the business (for example, by mail or over the. Compliance with visa’s requirements does not imply compliance with any relevant state laws.

It is considered a convenience because your business has provided the consumer another avenue to make a payment (outside of the standard payment channels). A convenience fee of [insert fee amount] will be charged for all credit card transactions. Participants in the program will be permitted to assess a convenience fee for mastercard transactions, whether conducted in person, internet, phone, mail or kiosk, versus other forms of Web what is a convenience fee? Sadly, cash use is down year on year, and no credit card transaction is free. Web a credit card convenience fee is an additional charge to your consumer beside the payment due. Web because convenience checks can be considered cash advances, they can come with fees and high interest rates. Web conveniencefees12032006 5 card association regulations: Download this printable we accept credit cards sign and use it to inform and remind customers that your business accepts credit cards so you can easily make purchases. (no spam, ever!) subscribe (free!) this sign is available in two versions:

For merchants that take credit card payments frequently, such as a grocery store, this fee is. Web a credit card convenience fee is an additional charge to your consumer beside the payment due. Convenience fees may be worth paying if you use your card enough to earn rewards. Credit and debit card payments will only be accepted online. How do you calculate that fee? Web reviewed by whitney blair wyckoff | june 7, 2022, at 9:00 a.m. Web putting up a simple yet informative printable sign can get the job done with perfection. Web because convenience checks can be considered cash advances, they can come with fees and high interest rates. 183t03802ru conveniently display your fee notice with this informative sign! Sadly, cash use is down year on year, and no credit card transaction is free.

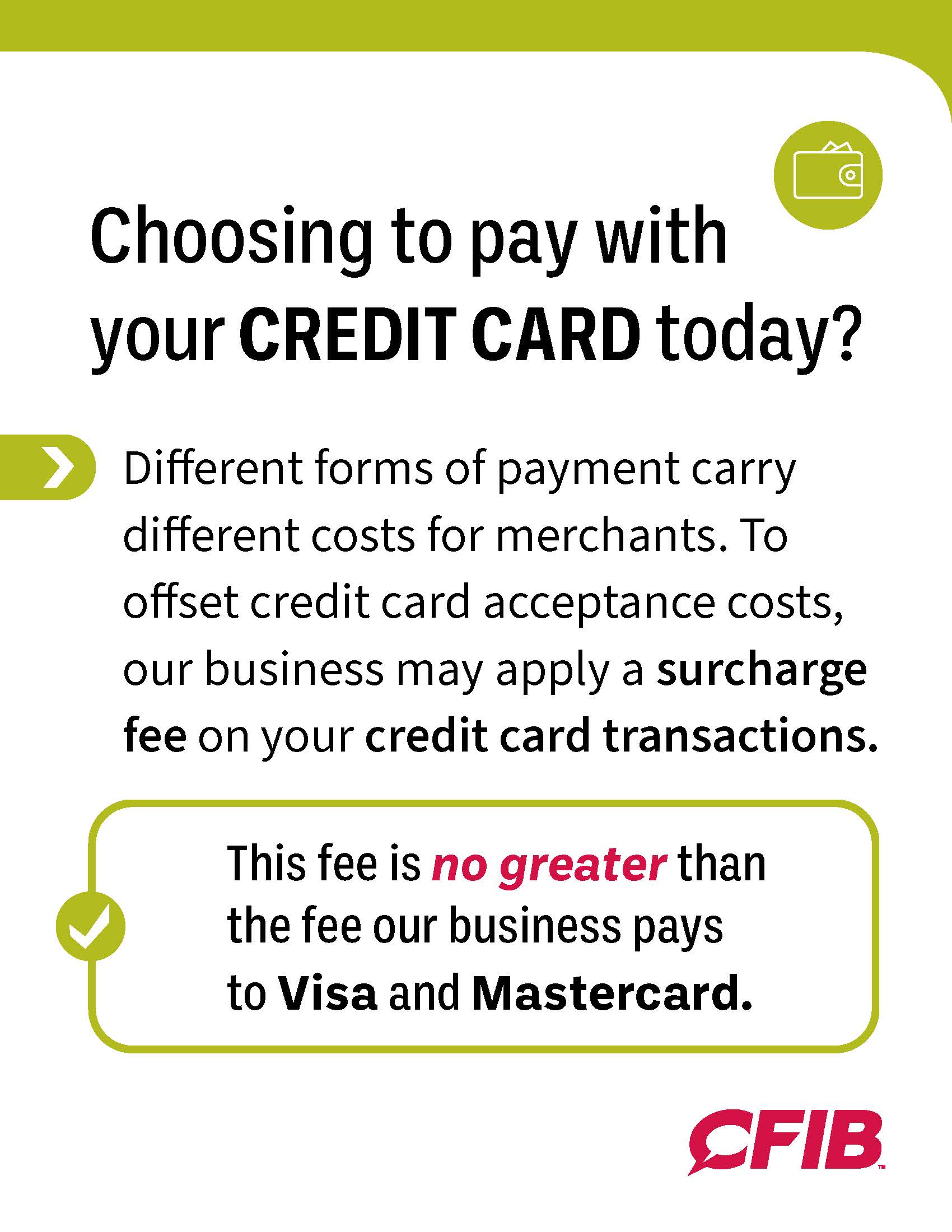

Surcharging and What It Means For Your Business

Thank you for your understanding.” A convenience fee of [insert fee amount] will be charged for all credit card transactions. Buy now & save 📣 only 00days:00hours:00minutes:00seconds Depending on the payment network, they may need to pay a merchant fee of around 2% or higher every time a customer pays with a credit card. Web as a merchant, you will.

Payment Options Progressive Family and Cosmetic Dentistry

Discover 5.8 surcharges you may permit merchants to assess a surcharge on a card sale conducted using a credit card, subject to the restrictions in section 2.4 of these operating regulations.you agree not to permit merchants to levy a fee or other penalty of any kind on a cardholder using a card Web a surcharge over 4% of the purchase.

Village Hall Archives Village of Third LakeVillage of Third Lake

Web conveniencefees12032006 5 card association regulations: Participants in the program will be permitted to assess a convenience fee for mastercard transactions, whether conducted in person, internet, phone, mail or kiosk, versus other forms of Use these templates to indicate if you accept credit cards, cash, or checks. Depending on the payment network, they may need to pay a merchant fee.

Convenience Fees and the Fair Debt Collection Practices Act

Web a surcharge over 4% of the purchase price is illegal and any surcharges are illegal in 10 of the 50 states — california, colorado, connecticut, florida, kansas, maine, massachusetts, new york,. Is it legal to charge a fee? Web different types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Participants.

Town Clerk & Public Meetings Clerk Highgate, Vermont

Web reviewed by whitney blair wyckoff | june 7, 2022, at 9:00 a.m. By using this sign template, you can avoid creating confusion and can speed up things. Web get this printable we take credit cards sign and let customers know before they reach the register that your business only accepts major credit cards and not cash. Web as a.

Cash Discount Program Credit Card Processing Leap Payments

Web november 10, 2022 in credit card processing, merchant tips and insights the world may prefer cards, but for many merchants, the fees for accepting them eat into critical profit margins. Buy now & save 📣 only 00days:00hours:00minutes:00seconds In 2021, cash payments accounted for 20% of all transactions, falling 6% from 2019. A convenience fee is a charge passed on.

NOTICE NEW CREDIT CARD FEES City of Flowery Branch

Prior to may 1, 2023: Web why merchants charge credit card convenience fees. Use these templates to indicate if you accept credit cards, cash, or checks. Accepting credit cards can be expensive for merchants. 183t03802ru conveniently display your fee notice with this informative sign!

Guide On Charging Credit Card Convenience Fees PDCflow Blog

Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Web conveniencefees12032006 5 card association regulations: Download this printable we accept credit cards sign and use it to inform and remind customers that your business accepts credit.

Pay Your Water Bill Online City of Carrollton, TX

Surcharge disclosure signage should be clear, Web putting up a simple yet informative printable sign can get the job done with perfection. Web why merchants charge credit card convenience fees. This collection of 20+ printable designs on we accept credit cards have unique outlooks that are presented in easily understandable and readable approaches, which can quickly spread the message among.

Pay Taxes With Credit Card Lowest Fee Rates and LimitedTime

Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Web get the information you need to know about charging your customers a credit card convenience fee. On the sign there are four famous major credit cards,.

For Merchants That Take Credit Card Payments Frequently, Such As A Grocery Store, This Fee Is.

A convenience fee is a fee that a merchant charges a customer for paying in a manner that’s not standard for the business (for example, by mail or over the. A convenience fee is a charge passed on to customers for the privilege of paying for a product or service using an alternative payment method that is not standard for a business. How do you calculate that fee? 183t03802ru conveniently display your fee notice with this informative sign!

Web We Accept Credit Cards Sign.

Thank you for your understanding.” Be sure to place the sign at a reasonable high in order for everyone to see it. Web subscribe to the free printable newsletter. Web because convenience checks can be considered cash advances, they can come with fees and high interest rates.

Credit And Debit Card Payments Will Only Be Accepted Online.

Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. In 2021, cash payments accounted for 20% of all transactions, falling 6% from 2019. Use these templates to indicate if you accept credit cards, cash, or checks. Just download one, open it in a program that can display the pdf file format, and print.

Web The Only Common Fees You Might Run Into Are Outgoing Wire Transfer Fees Of Up To $30, And Fees Of $7 And $11, Respectively, For Orders Of 50 Or 100 Paper Checks.

Participants in the program will be permitted to assess a convenience fee for mastercard transactions, whether conducted in person, internet, phone, mail or kiosk, versus other forms of Prior to may 1, 2023: Web as a merchant, you will need to provide customers with a surcharge disclosure, also known as a checkout fee, when including additional fees for accepting a credit card. Depending on the payment network, they may need to pay a merchant fee of around 2% or higher every time a customer pays with a credit card.