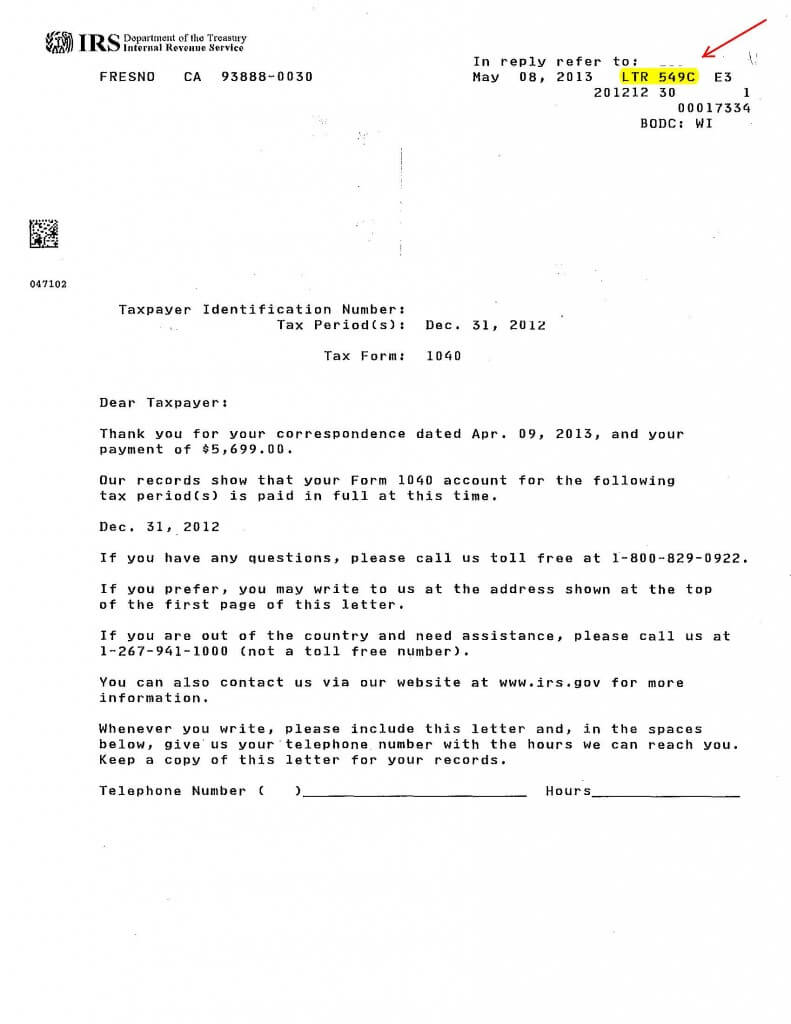

Response Letter To Irs Template

Response Letter To Irs Template - Web do to respond. Web when should i send an explanation letter to the irs? Send an explanation letter when responding to an. • you are due a larger refund; • you owe additional tax; Generally, the irs sends a letter if: Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your.

Generally, the irs sends a letter if: Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your. Web when should i send an explanation letter to the irs? Web do to respond. • you owe additional tax; • you are due a larger refund; Send an explanation letter when responding to an.

Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your. • you are due a larger refund; Generally, the irs sends a letter if: Web do to respond. • you owe additional tax; Send an explanation letter when responding to an. Web when should i send an explanation letter to the irs?

Response Letter To Irs Template

• you owe additional tax; Send an explanation letter when responding to an. Web do to respond. Web when should i send an explanation letter to the irs? • you are due a larger refund;

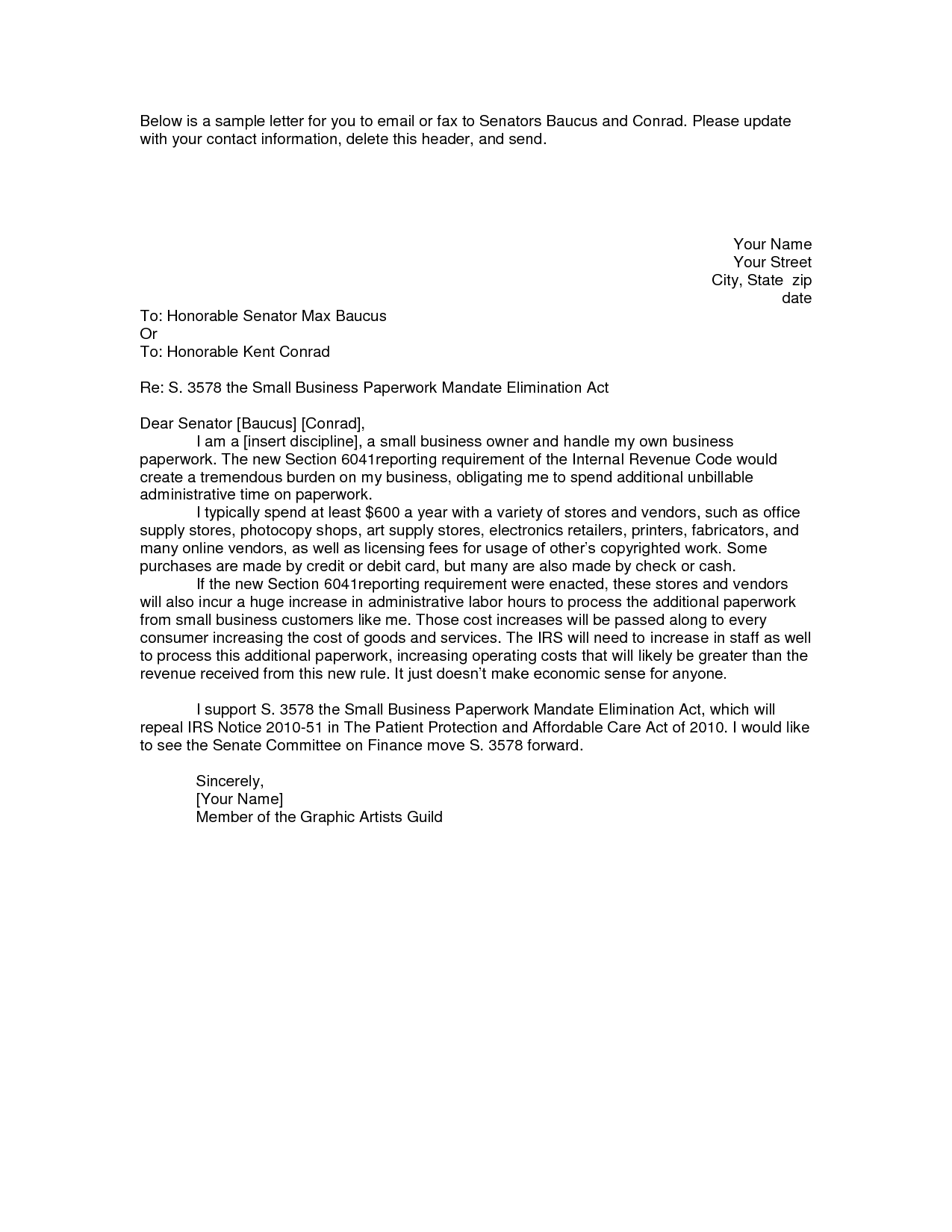

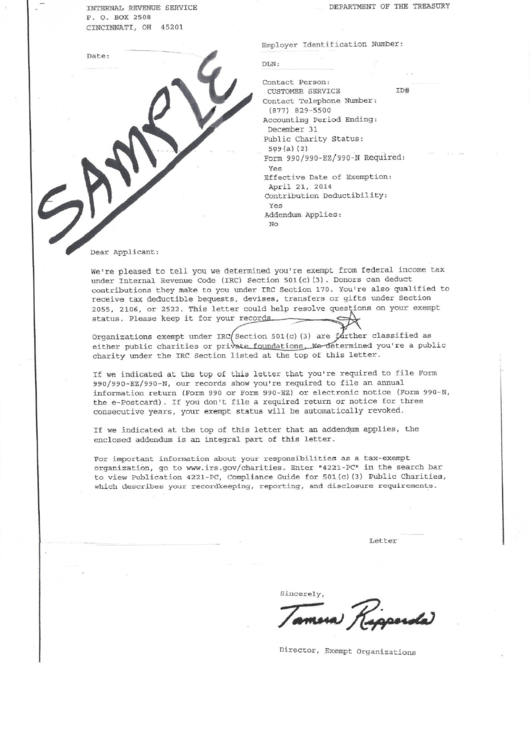

Sample Letter To Irs Free Printable Documents

Web when should i send an explanation letter to the irs? Send an explanation letter when responding to an. Generally, the irs sends a letter if: • you owe additional tax; • you are due a larger refund;

IRS Response Letter Template Federal Government Of The United States

• you are due a larger refund; Web when should i send an explanation letter to the irs? Generally, the irs sends a letter if: Send an explanation letter when responding to an. • you owe additional tax;

Letter to the IRS IRS Response Letter Form (with Sample)

Generally, the irs sends a letter if: Web when should i send an explanation letter to the irs? Send an explanation letter when responding to an. Web do to respond. Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your.

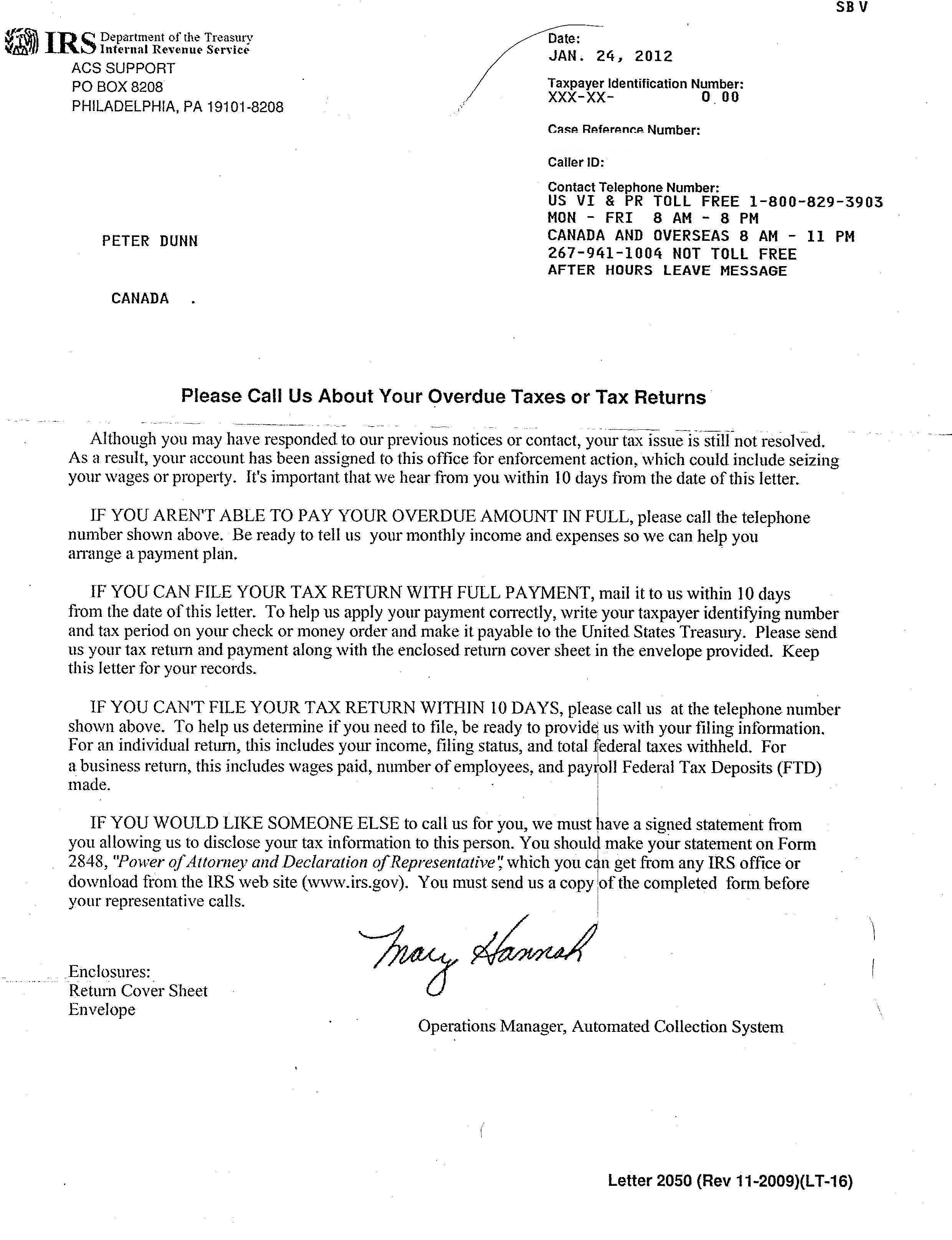

Irs Response Letter Template in 2022 Letter templates, Business

• you are due a larger refund; Web when should i send an explanation letter to the irs? • you owe additional tax; Generally, the irs sends a letter if: Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your.

Letter To Irs Free Printable Documents

Send an explanation letter when responding to an. Generally, the irs sends a letter if: Web do to respond. Web when should i send an explanation letter to the irs? • you are due a larger refund;

IRS Audit Notice How to Survive One (With Free Response Template!)

• you are due a larger refund; Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your. • you owe additional tax; Web do to respond. Generally, the irs sends a letter if:

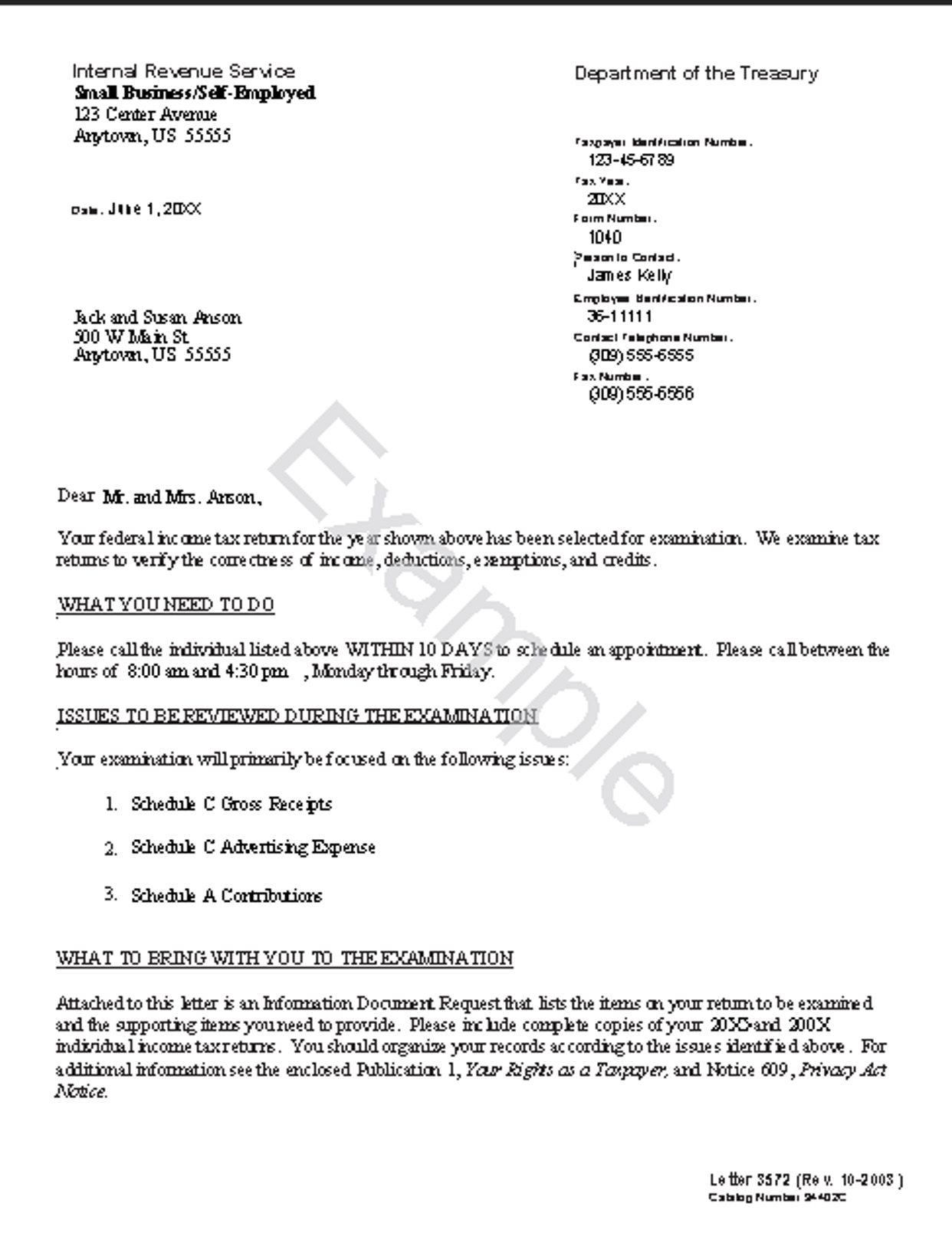

Audit Letter 3572 Steps to Answer & Respond to the IRS

• you are due a larger refund; • you owe additional tax; Web do to respond. Generally, the irs sends a letter if: Web when should i send an explanation letter to the irs?

How To Respond To Irs Audit Letter Sample letters

Send an explanation letter when responding to an. • you owe additional tax; Web when should i send an explanation letter to the irs? • you are due a larger refund; Web do to respond.

Example Of Irs Letter Template printable pdf download

Send an explanation letter when responding to an. Web do to respond. • you are due a larger refund; Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your. • you owe additional tax;

• You Owe Additional Tax;

Web do to respond. Web when should i send an explanation letter to the irs? Send an explanation letter when responding to an. Generally, the irs sends a letter if:

• You Are Due A Larger Refund;

Web if we changed your tax return, compare the information we provided in the notice or letter with the information in your.