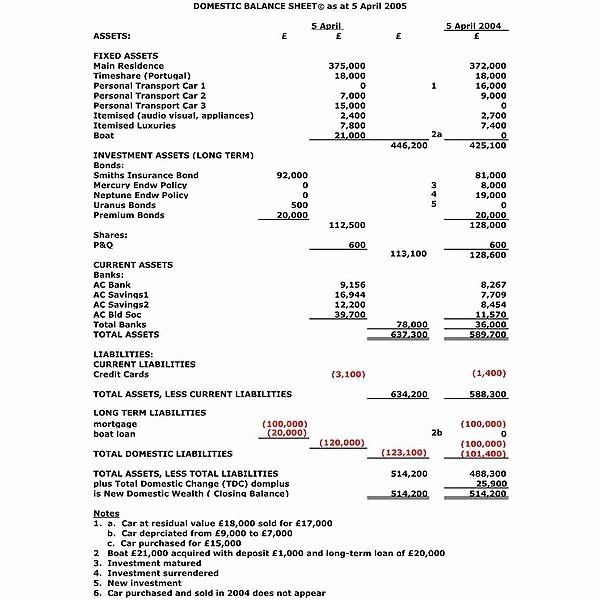

S Corp Balance Sheet

S Corp Balance Sheet - Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

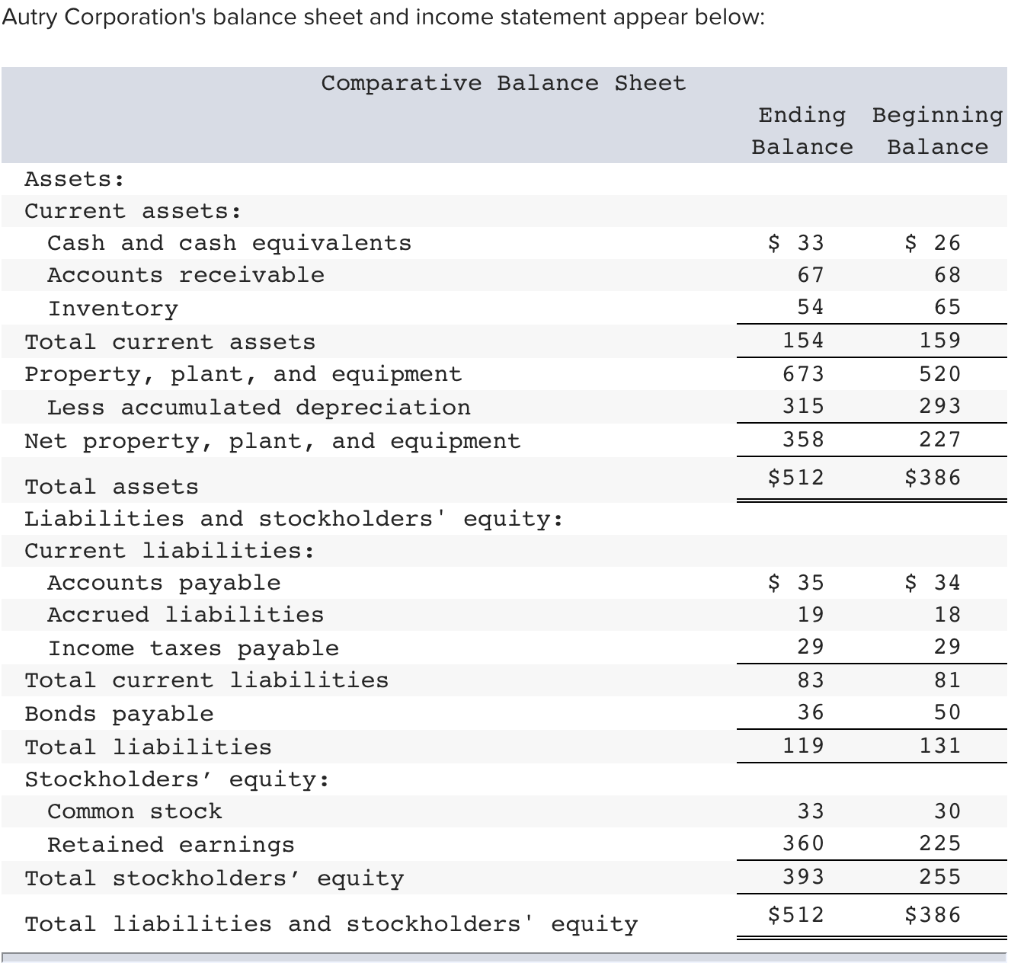

Solved Hyrkas Corporation's most recent balance sheet and

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

Balance Sheet By Products and Services QuickBooks Data in Google Sheets

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

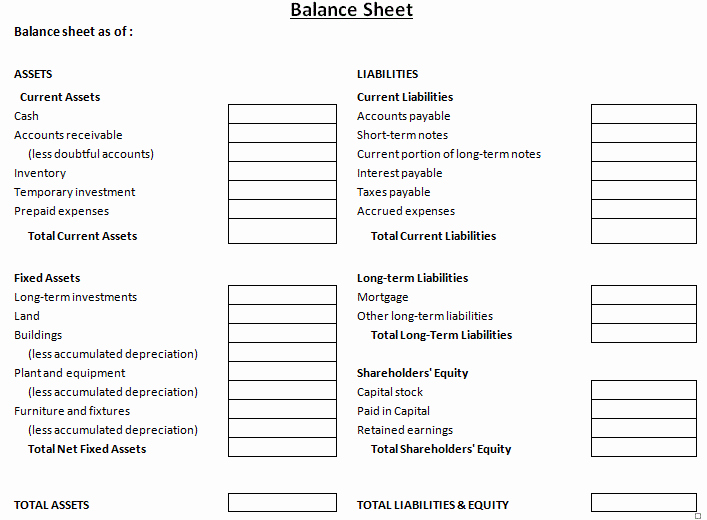

50 S Corp Balance Sheet Template Template

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

50 S Corp Balance Sheet Template

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

Sample Balance Sheets and Examples Statement

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

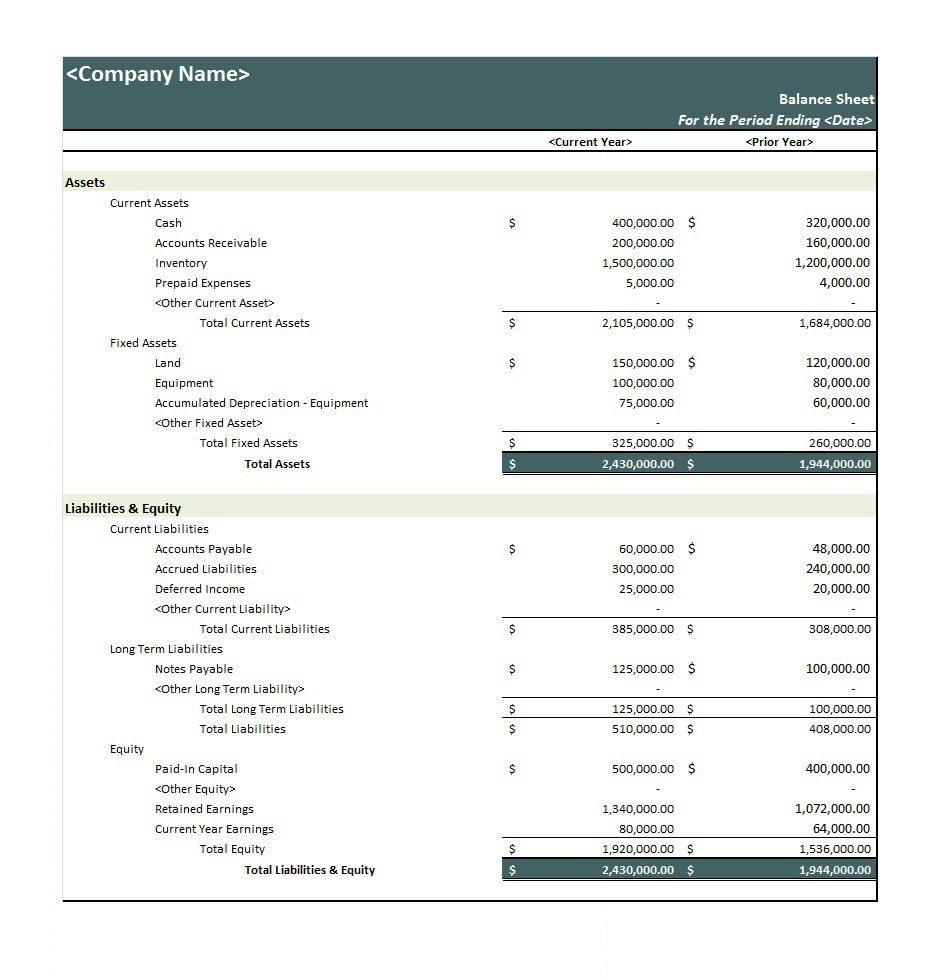

Excel Spreadsheet Balance Sheet Template

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

50 S Corp Balance Sheet Template Template

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

S Corp Balance Sheet Template Verkanarobtowner

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.

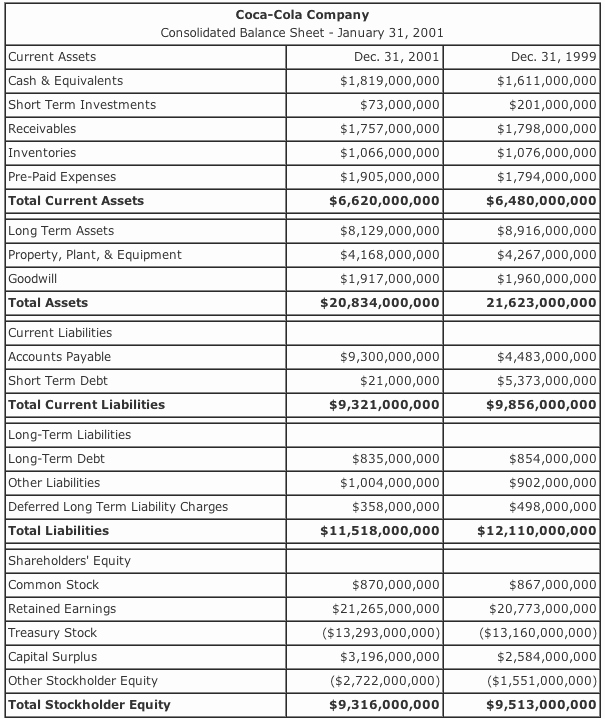

S Corp Vs. C Corp Valuation

Web at the close of the tax year, if your s corp’s total receipts and total assets amount to $250,000 or more, you are required by the.