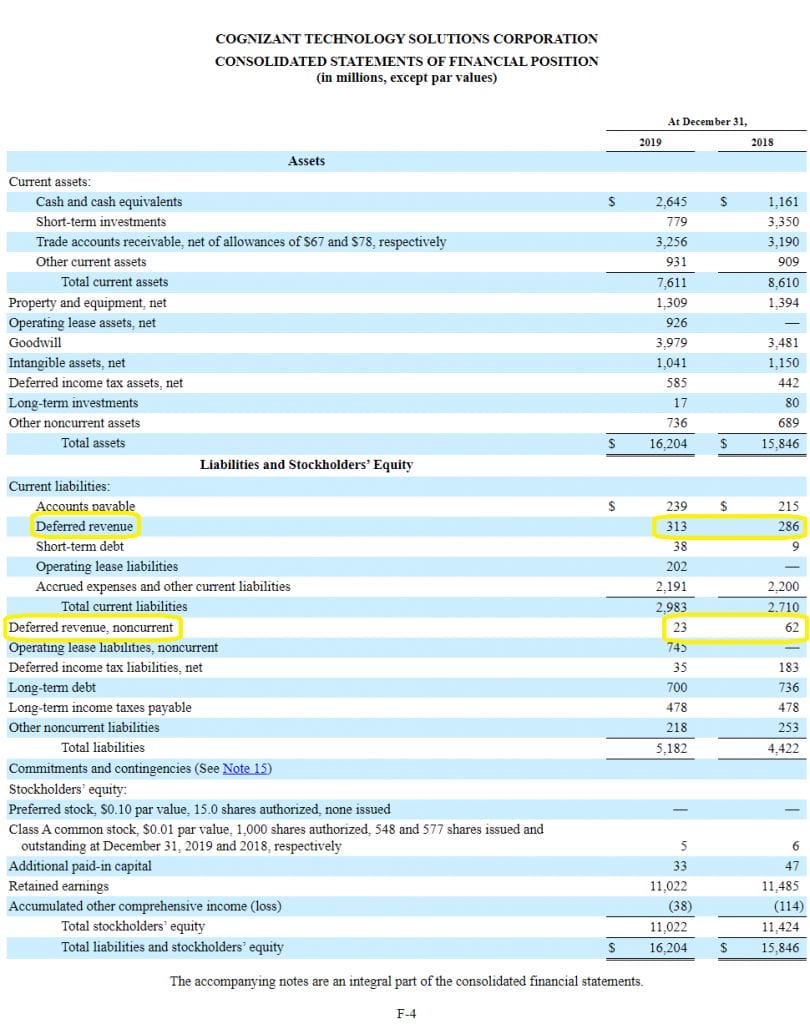

What Is Deferred Revenue On Balance Sheet

What Is Deferred Revenue On Balance Sheet - Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future.

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web deferred revenue is revenue received for services or goods to be delivered in the future.

Web deferred revenue is revenue received for services or goods to be delivered in the future. Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

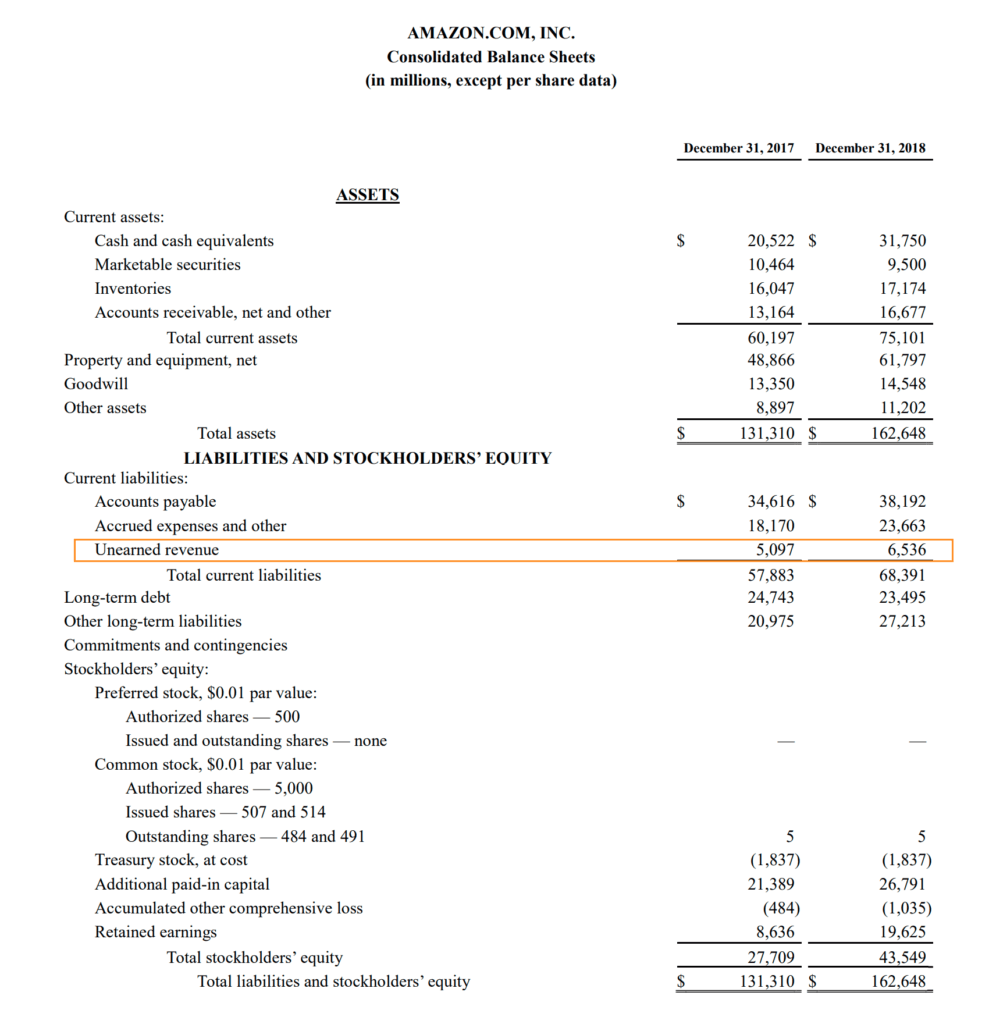

Unearned Revenue Definition, How To Record, Example

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future.

What Is Deferred Revenue? Complete Guide Pareto Labs

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

Deferred Revenue Definition + Examples

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

What is Unearned Revenue? QuickBooks Canada Blog

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future.

What is Unearned Revenue? QuickBooks Canada Blog

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future.

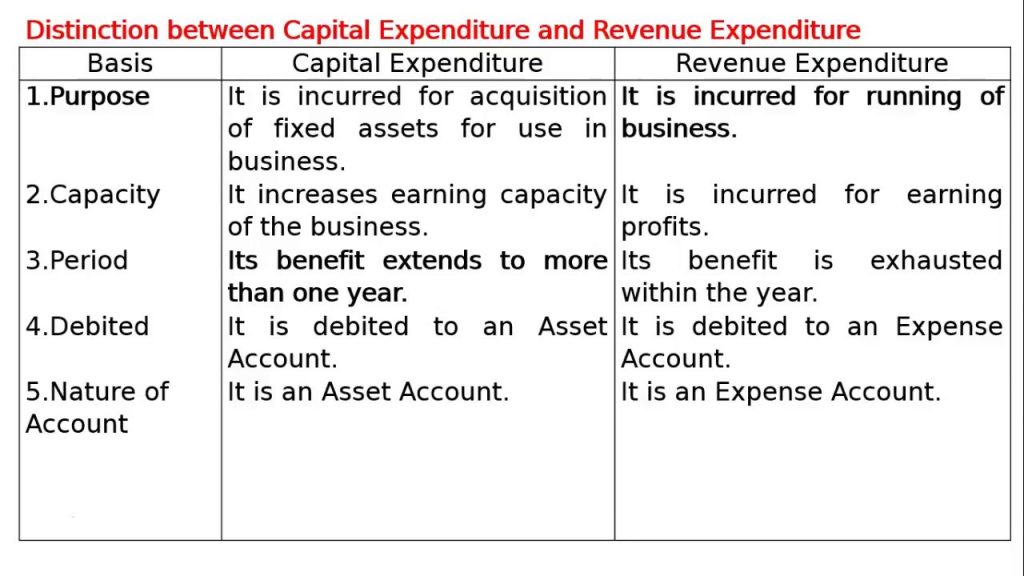

Deferred Revenue Expenditure Study Equation

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

What is Deferred Revenue? The Ultimate Guide (2022)

Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the. Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future.

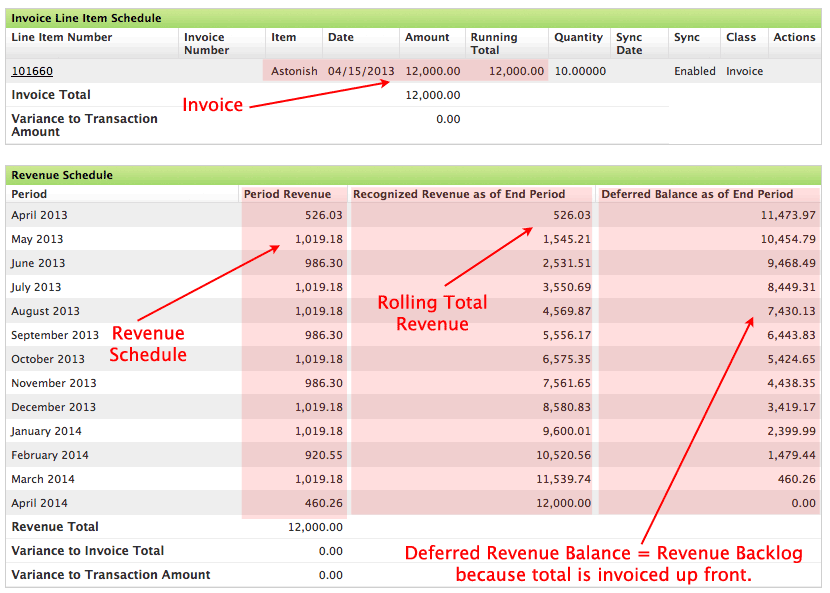

What is Deferred Revenue in a SaaS Business? SaaSOptics

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the.

What is Deferred Revenue in a SaaS Business? SaaSOptics

Web on the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Web deferred revenue is revenue received for services or goods to be delivered in the future. Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the.

Web On The Balance Sheet, Cash Would Increase By $1,200, And A Liability Called Deferred Revenue Of $1,200 Would Be Created.

Web deferred revenue is revenue received for services or goods to be delivered in the future. Web deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the.